The offers come in a deluge each week: Cash back! Zero percent

APR! No annual spending limit! Win a trip to Hawaii!

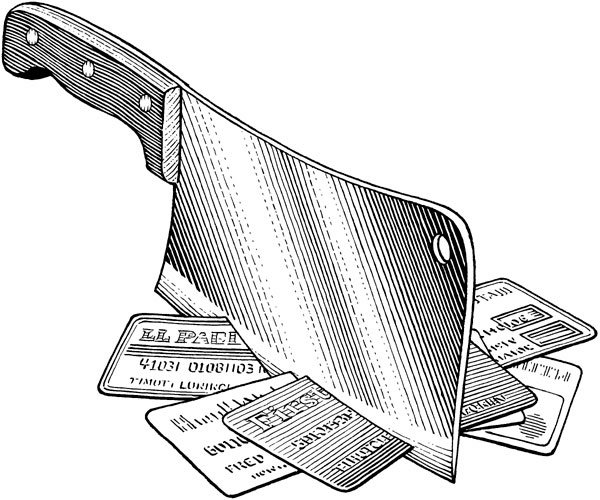

Plastic seduces our nation with the notion of the easy life, of

convenience. And how convenient it has become.

These days consumers can pay for their Starbucks latte with an

American Express card or pick up McDonalds for the kids with a

Visa. In fact, last year, Americans charged nearly $13 billion for

fast food.

The offers come in a deluge each week: Cash back! Zero percent APR! No annual spending limit! Win a trip to Hawaii!

Plastic seduces our nation with the notion of the easy life, of convenience. And how convenient it has become.

These days consumers can pay for their Starbucks latte with an American Express card or pick up McDonalds for the kids with a Visa. In fact, last year, Americans charged nearly $13 billion for fast food.

Card companies entice everyday Americans to pay for the simple things – groceries, phone bills and other minor expenses – with offers of free airline miles or special member savings like American Express’ double points for grocery purchases.

According to industry statistics available on CardWeb.com, the average debt per household has climbed to $9,025. That’s more than $1,000 above where it stood last year.

Those numbers aren’t all frivolous spending, either.

An increasing number of Americans are turning to credit as a bridge for insufficient funds, putting the basics on a card and watching their balance roll from month to month, snowballing out of control.

MSN Money columnist M.P. Dunleavey has named this trend “survival debt,” in reference to what she sees as a nation living paycheck to paycheck.

She noted that in 1993, Americans saved an average of 5.9 percent from their yearly income. By 2003, that number had dwindled to a barely recognizable 1.3 percent.

“When we look at the kinds of people who are filing bankruptcy, they’re not living the lives of a multi-millionaire or a dot-com boomer,” said Carmela Vignocchi, director of public relations for Consumer Credit Counseling Services, a non-profit debt counseling service. “They’re spending on things like rent and bills. Americans save so, so little. How many people have three months worth of savings? Do you?”

Choosing to try and fix money problems with a credit card simply gets consumers in deeper. We currently spend $1.10 for every dollar we make, according to Vignocchi.

So if a person pays for an unexpected car repair with credit in October thinking they’ll pay it off in November, what happens when November’s bills come? The cycle repeats, growing deeper as interest rates compound.

It is difficult to tell exactly how many people are going further and further into survival debt. Credit card companies don’t keep statistical records on who pays off which expenses incurred on their accounts.

However, they have tracked the amount spent on household goods – the aforementioned rent, food and phone bills along with things like insurance payments – and the numbers are shocking. Visa cardholders spent a whopping $50.6 billion on these commodities last year alone. The card company represents a 50 percent share of the total market.

People are also more indulgent with credit cards, even in trivial situations. At fast food terminals, the choice to pay with a credit card generally drives up sales amounts by 25 to 30 percent, according to Robert McKinley, CEO of CardWeb.com.

And therein lies the problem. The issue of survival debt isn’t about whether or not it’s a new trend (Vignocchi would say it’s not), but about the rate and volume of what is happening.

Consumers can pay with plastic at more places than ever before, and they’re abusing the privilege. The number of people paying their taxes with plastic has shot up six times since 1999 and is projected to continue growing.

“We’ve been around since 1966, so I believe with an almost 40-year perspective, we have a picture of what has been happening in our society as debt has become more and more available to consumers in our society and credit has become easier and easier to get,” said Vignocchi. “People have fallen under the spell of consumerism.”

Do you have a debt problem?

• Are your savings non-existent or inadequate?

• Are you thinking of borrowing money to pay off debts unrelated to the mortgage?

• Are you at or near the limit on your credit cards?

• Are you sure about how much you owe? (Total, not the minimum payment.)

• Is an increasing amount of your income spent on paying existing debts?

• Are you only making the minimum payments?

• Are you paying with a credit card for what you used to pay in cash?

• If you lost your job would you be in immediate financial distress?

If you answered yes to two of these questions, it may be time to see a credit counselor.

Credit services

Not all credit reduction services are alike, so make sure that yours is a true non-profit with credentialed counselors. Several purported credit counselors are under investigation by the Securities and Exchange Commission, so make sure yours is on the up and up by contacting the Better Business Bureau or visiting the National Foundation for Credit Counseling at www.nfcc.org. For more information on the Consumer Credit Counseling Service, visit their Web site at www.gotdebt.org.