A steep decline in property values has officially hit Gilroy and

Morgan Hill hardest in Santa Clara County.

A steep decline in property values has officially hit Gilroy and Morgan Hill hardest in Santa Clara County.

County Tax Assessor Larry Stone announced the steepest fall in property values since the Great Depression last week.

That’s rough news for cities, the county and school districts. It also signals a decline in property values for homeowners, but they, at least, will get some relief with a drop in their property tax bills next year.

The county has not seen such deeply negative growth in property values since the Great Depression, except in 1978 when Proposition 13 capped assessed values’ annual growth statewide – “a political, not economic circumstance,” Stone said. That year, property values decreased by about 21 percent.

“This is far worse than anyone had expected. It is very difficult for me to deliver such distressing news. As a citizen and taxpayer, I am concerned about additional cuts to public schools and other public services funded by property taxes. I am concerned about the significant loss of equity by our property owners,” Stone said.

During the Great Depression, while the county saw three consecutive years of negative growth in assessed values, only one of those years saw a steeper decline than this year. In 1933, the county’s assessment roll dropped by 3.19 percent.

This year’s rate of decline is “especially alarming” considering a $20 billion increase in property values only two years ago, and $27 billion in growth in 2001, Stone added.

The cumulative assessed value of privately owned properties determines the amount of property tax revenues due each year to local cities and school districts, as well as to the state and the county – revenues which help fund public services.

The overall decline of about 2.43 percent since last year in the county’s residential and commercial properties brings the total property roll to about $296.47 billion, according to the assessor’s office.

Property owners in Morgan Hill and Gilroy will see their collective assessed values fall by 6.1 percent. That’s a larger percentage decline than any other city in the county.

In Gilroy, City Administrator Tom Haglund said the staff anticipated and budgeted for the decline. The assessment roll in Gilroy dropped from about $6.1 billion to about $5.8 billion. Haglund said the city makes “conservative” revenue estimates when the budget is drafted.

“The city anticipated these revenue reductions and has carefully evaluated the real estate market over the past year, and has included property tax reductions consistent with what the county assessor is now estimating,” Haglund said.

In Morgan Hill, the assessment roll decreased from last year’s value of about $6.6 billion, to about $6.2 billion this year.

City staff revised its projected secured property tax revenues for fiscal year 2010-2011 downward by about 5 percent, or about $250,000, after the assessor’s office announced in May that it would devalue about 1,100 Morgan Hill properties, according to city Budget Manager Jimmy Forbis.

It is difficult to determine what the exact impact the decline in revenues will have on services, because the city receives revenue from a variety of sources, not all of which are dictated by property values.

“The budget is a constantly moving picture,” Forbis said. “Before we start recommending budget adjustments, we take all revenues into account including sales and hotel tax.”

The city’s budget and forecasts each year include “dozens” of revenue sources, Morgan Hill City Manager Ed Tewes added.

While the city expects growth in sales tax revenues, which have plummeted since their peak in 2007, by next spring, staff do not expect property tax revenues to grow in the next year.

In other bad news from the assessor’s office, the number of businesses still open throughout the county declined by about 8.2 percent, to 42,000, Stone said. And “the biggest surprise” was an 8 percent drop in the value of business personal property, including machinery, equipment, computers and fixtures.

This contraction of business, like the fall of property values, is caused by the county’s worsening unemployment rate and unstable financial markets, Stone said.

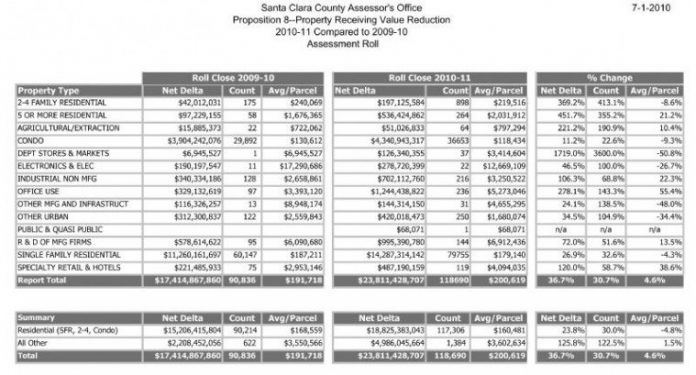

A lack of investment in real estate, as compared to recent years, has also contributed to the ebb of business activity. Commercial, industrial and retail establishments receiving reductions increased 122 percent since last year, and the amount of the reduction more than doubled from $2.2 billion to $4.9 billion, Stone said.

But these numbers are “only the tip of the iceberg,” Stone said. The assessor’s office has not yet conducted widespread appraisals of the county’s commercial properties, as it has for 220,000 residential properties in the last two years.

Stone expects to see the value of commercial properties to decline even further as business owners file assessment appeals over the next few years.

In the residential sector, the number of homes receiving a temporary reduction increased from 90,214 to 117,306 since last year. However, the rate of decline slowed overall, reflecting the bottom might have been reached in the struggling housing market.

And for the first time since Proposition 13 passed, the California Consumer Price Index was negative by 0.237 percent, Stone added. Proposition 13 says the assessed value of all real property cannot increase by more than 2 percent annually, unless there is a change of ownership or new construction. Thus, an estimated 350,000 property owners will receive a reduction in the assessed value of their property, totaling $6 billion, including properties in which the assessed value is significantly below the market value.

This year’s unprecedented decline in the assessment roll is “a direct consequence of soaring unemployment” in Santa Clara County, Stone said.

“Unemployed workers are no longer able to make mortgage payments, and reduce the purchase of consumer products,” Stone said.

“The result is not only distressed sales and foreclosed homes, but major retailers, such as Mervyns, Blockbuster and Circuit City, are filing for bankruptcy.”