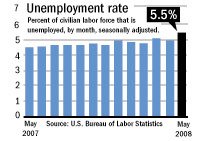

The unemployment rate surged in May to its largest monthly

increase in 22 years and employers shed jobs for the fifth

consecutive month, the government reported Friday.

The unemployment rate surged in May to its largest monthly increase in 22 years and employers shed jobs for the fifth consecutive month, the government reported Friday.

The grim report from the Labor Department’s Bureau of Labor Statistics came as many economic analysts were projecting minimal job losses. Instead, Friday’s report showed an unusually large leap in the unemployment rate of half a percentage point, to 5.5 percent. And the agency said that employers had trimmed payrolls by 49,000 jobs.

The takeaway from the numbers is this: Americans – already facing high energy prices, weak income growth and rising prices at the grocery store – can add job security to their list of economic concerns.

“Recession is written all over the jobs numbers. The job losses are significant and broad across many industries and areas of the country,” Mark Zandi, the chief economist for forecaster Moody’s Economy.com, told McClatchy.

The surge in the unemployment rate probably overstates the job-market weakening in May, he said, because it could reflect a large number of college students looking for work early because they know it will be tougher to find jobs this summer.

“Nonetheless, the job market is eroding and so too is the broader economy,” Zandi said.

Adding to the concerns, contracts for future deliveries of crude oil, called futures contracts, surged almost $7 a barrel when trading began Friday on the New York Mercantile Exchange. Oil had pulled back toward $120 a barrel but Thursday contracts settled up by a record $5.49 to $127.79.

The jobs report and oil’s surge sent stocks skidding at the start of trading. The Dow Jones Industrial Average was down more than 220 points within half an hour after the markets opened.

The Federal Reserve is sure to find the jobs report troubling. With a slumping economy, monetary policymakers usually want to cut interest rates to spark the economy. But the tone of speeches from Fed Chairman Ben Bernanke and other Fed leaders is increasingly hawkish about growing inflation threats, which argue for rate cuts.

However, raising interest rates at a time when more Americans are tossed out of work and facing record fuel bills would be an unpopular move.

The economy appears to be worsening just as the presidential general election kicks off. Presumptive Democratic nominee Sen. Barack Obama issued a statement Friday morning lamenting the new jobs numbers.

“In the first five months of 2008, our economy has lost 324,000 jobs and workers’ wages once again failed to keep pace with the skyrocketing cost of health care, and college tuition, and gas,” he said, promising a platform of job growth if elected.

The nuts and bolts of the jobs data pointed to a continuing trend. The leading job-losing industries were construction and manufacturing, reflecting the slowdown in the housing and building sectors and weakening consumer demand as paychecks are stretched. The top job-creating sectors were education and health services.

The job numbers are the latest in a long string of bad news.

On Thursday, the Mortgage Bankers Association reported that one in every 100 homes had entered foreclosure proceedings during the first three months of this year. The overall share of homes in foreclosure jumped to a record high of 2.47 percent. The mortgage delinquency rate – people behind on payments – also hit a record in the first quarter, of 6.35 percent.

With more and more Americans at risk of losing their homes and shelling out more money for food, gasoline and medical care, it’s no surprise that surveys of consumer confidence show pessimism.

The latest such reading came from the RBC Cash Index, a survey of consumer attitudes and spending by household. The index, released Thursday, showed an across-the-board souring of consumer sentiment and stands at a record low 22.5, nearly 17 points below the May reading of 39.0.

“Despite economic stimulus checks being sent to millions of Americans (by the federal government), this month’s reading indicates consumers are under extreme and growing financial pressure from falling house prices, rising food and energy prices and a softening job market,” said T.J. Marta, an analyst with the publish of the index, RBC Capital Markets.