The CHP blacklisted Paul Greer’s towing company, but hundreds of

motorists were still ordered to pay B

&

amp;C towing thousands of dollars in judgments and fees

Gilroy – Efreen Gonzalez’ voice quivered as he stood before the court. He could not afford to have his bank account emptied, he struggled to explain, over a lawsuit he never had a chance to fight. After all, no one told him his car was towed, no one told him it was sold, and no one told him he’d been sued by the towing company for storage and legal fees.

Despite his pleas last summer, Gonzalez lost the case and had nearly $4,000 drained from his bank account.

“This is the United States, where everything goes by the law,” said Gonzales, 37, a father of three who moved from Jalisco, Mexico 20 years ago. “I don’t think the law worked in my case.”

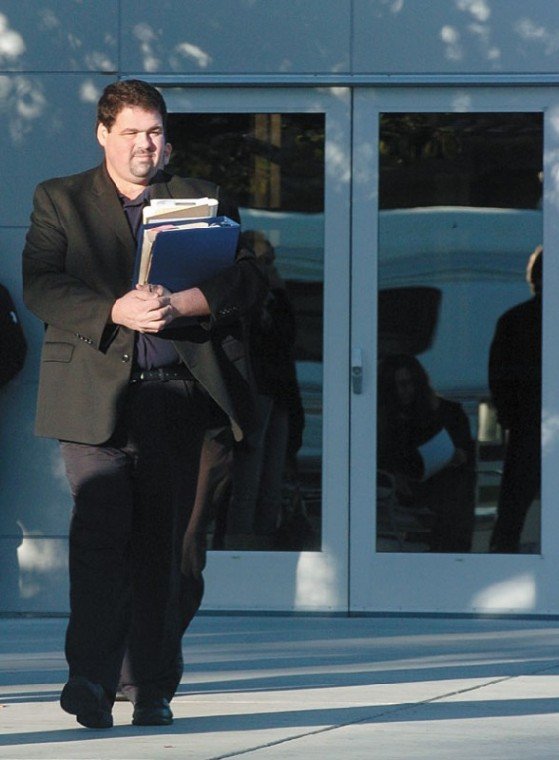

Gonzalez is one of hundreds of unsuspecting motorists dragged into court by former tow truck operator Paul Greer, who was blacklisted out of business by the California Highway Patrol in 2004 after they accused him of posing a “criminal threat” to the community.

But even after being effectively shut down by the CHP’s action – honored by every law enforcement agency in the region – Greer turned the remnants of his business into a small claims court money machine whose suspect practices, measured by a slew of complaints in two counties, have gone largely unchecked by judges, district attorneys and law enforcement agencies.

A six-month Dispatch investigation of Greer, 29, uncovered a litany of questionable business practices and legal maneuvers, the latter apparently such a misuse of the legal system that it was labeled “a fraud on the court” by San Jose consumer rights attorney Scott Maurer.

For example, the Dispatch found evidence a court summons was delivered to an empty apartment and court documents were altered. In addition, the CHP determined – and a court agreed – that Greer had overcharged customers and operated without insurance and a permit. In a lawsuit for control of the family towing business, Greer’s own father accused him of embezzlement and theft of company assets.

Gonzalez, who owns a small Hollister landscaping business, ran afoul of Greer’s B&C Towing when he loaned a maroon 1990 Oldsmobile Cutlass to a relative, who died while in possession of the car. Greer hauled the Cutlass off the street at the request of Gilroy police and, seven months later, sued Gonzalez for $1,945 in towing and storage fees. Gonzalez did not show up for the small claims court trial and lost by default. When he failed to pay Greer, the tow truck owner again enlisted the court’s help, this time to raid Gonzalez’ bank account for the judgment.

That brought Gonzalez and Greer face to face in San Martin small claims court July 6, 2006. His voice choked with emotion, Gonzalez pleaded with Commissioner Gregory Saldivar to prevent Greer from levying his bank account, explaining that he had a family and could not afford to pay. Plus – and this was the crux of his argument – Gonzalez claimed he never received the legal notice of the lawsuit and never had a chance to defend himself.

Documents Greer submitted to the court told a different story: A vehicle registration showed Gonzalez owned the car; a certified mailing receipt showed that he was notified of the car’s sale; and a process server’s sworn statement showed that a notice to appear in court was hand delivered in April 2005 to Gonzalez at his Gilroy home, 1180 Driftwood Terrace, Apt. A.

Gonzalez tried to explain that he had not lived at the apartment for a decade, but Commissioner Saldivar cut him off after a few seconds. Gonzalez was ordered to return with financial documents to prove his claim that he could not pay. He lost the case and paid nearly $4,000, much of it for Greer’s court fees and late payment penalties, he said.

Months after the court’s ruling, however, a Gilroy property manager corroborated Gonzalez’ story. No one named “Gonzalez” lived in Apt. A at 1180 Driftwood Terrace in the five years since South Valley Property Management took over the apartments, Sue Fullington told the Dispatch in November 2006. In a sworn affidavit filed in court a month later, she went even further, stating that the apartment was vacant on the day that Greer’s process server, Jeff Horan, purportedly hand delivered the summons to Gonzalez.

The discrepancy suggests Gonzalez was prevented from obtaining evidence needed to defend himself in court – the definition of extrinsic fraud, according to Maurer. “It’s a fraud on the court and I imagine it caused (Gonzalez) to feel very cynical about the whole legal process,” said Maurer, of the Alexander Community Law Center. “That kind of fraud … keeps people from having their day in court.”

Greer, a former Hollister resident who lives in Clovis, said he does not get involved with the delivery of legal papers and that he has no idea whether Horan delivered the legal notice properly.

“We take the proof of service at face value,” he said.

Horan did not return repeated calls for comment.

58 cases net $139,000

The Gonzalez case is one of 363 small claims suits Greer has filed since 2003 in San Benito and Santa Clara counties, according to a Dispatch review of court documents. As the cases pile up, so do the complaints.

“At no time did I receive any notification from B&C Towing about the car being towed with charges,” Loren Young, of San Jose, stated in a letter responding to a Greer lawsuit. The San Martin court ordered her to pay $2,716, despite her complaint that legal papers had been left outside her door while she was out of state. Similar to the Gonzalez’ case, the proof of service filed in court by Horan states he delivered the summons to her in person.

In another case, filed in Hollister, Anna Martinez described her struggle with the aftermath of a Greer lawsuit. She complained in a November 2004 letter to the court that Greer had tacked $3,419 in post-judgment fees onto an original court award of $1,919.

“I am a struggling nursing student living paycheck to paycheck,” she wrote. “I have tried to work with this man to pay this bill off but he will not respond or be reasonably (sic) about this case.”

San Benito County Superior Court Judge Harry Tobias allowed the original judgment to stand but ordered the return of about $1,200 Greer had levied from Martinez’ bank account. She had to wait five months for her cash.

Small victories such as Martinez recouping $1,200 hardly dented Greer’s bottom line. A Dispatch review of 58 Greer victories in San Martin showed that he netted more than $139,000 in judgments and court fees. That’s an average of about $2,400 per towed car.

Greer has filed two thirds of his 363 cases in small claims court in San Martin. Of those, he won more than 140 cases, 119 of them because the defendant did not appear in court – the same as Gonzalez.

Father files suit against his son

In addition to angry defendants, Greer has run afoul of the California Highway Patrol and a San Benito County superior court judge.

In March 2006, Judge Harry Tobias demanded that Greer explain alterations on a court order to levy a defendant’s bank account. The original document authorized the San Benito County sheriff’s office to seize funds on Greer’s behalf. Later, the document was changed to apply in Santa Clara County and the fees were increased, according to a court clerk supervisor who flagged the alteration.

The clerk, Nancy Iler, discovered that someone had crossed out the words “San Benito County” and hand written “Santa Clara County” in their place. In a letter to Greer, Iler said the initials “SB” accompanying the change were not written by court clerk Sarah Bertine, who issued the original document. Iler also notified Greer that Tobias was demanding a written explanation of the changes, and that the case would not proceed until Greer responded.

Iler said she did not refer the matter to the district attorney or sheriff’s office for investigation, and she said no one from those offices ever questioned her about the altered document. Tobias and Greer said the matter was handled verbally shortly after the written notice, but neither provided details of the explanation. Tobias has not returned multiple calls asking for elaboration.

In a 2003 lawsuit, Greer was accused of embezzlement and theft by the man who started him in the towing and small claims business – his father.

Vincent Cardinalli Sr. accused his son Paul Greer (formerly Vincent Cardinalli Jr.) and other family members of embezzling $40,000 and stealing a computer, tow equipment and other corporate assets of A&R Associates. Cardinalli formed the company in 2002 after his prior towing business declared bankruptcy. He planned to retire and hand over the company to Greer and several other children, according to court documents. Instead, he found himself fighting them in court.

“Simply put,” Cardinalli Sr.’s lawyer Samuel Phillips stated in the case, “Vincent Cardinalli Jr. highjacked A&R Towing.”

The court case was settled, but as a condition of the settlement both sides agreed not to discuss the case publicly.

CHP pulls the plug on operator

Greer’s tangle with the California Highway Patrol, however, is a matter of public record.

Citing multiple instances of excessive and unjustified fees, abandoning a call and operating without insurance or a permit – 42 violations in five weeks – the CHP banned Greer in 2004 from doing business with the agency for three years. The investigation focused only on complaints to CHP about towing on state highways in the Gilroy-Hollister region.

That number of violations in such a short time span suggests “that B&C Tow(ing) is doing business in such a substandard manner so as to pose a criminal threat of negligence and occasional fraud to the community,” CHP Investigating Officer Dave Singer wrote in his report.

Greer took the CHP to court over Singer’s recommendation that he be barred for three years from the rotation. He argued that it would effectively put him out of business since local police only work with tow companies on the CHP roster.

Judge Tobias ruled in favor of the CHP and the termination took effect Sept. 17, 2004. He is eligible to reapply for the rotation in September.

Greer chalked up the CHP decision to a personal vendetta by one of the agency’s officers. He said his lawyers are “looking into” the matter. In the meantime, Greer said he is unsure if he will try to get back on the towing rotation.

“Seeing the system that he has, he’s probably going to keep victimizing people and committing more fraud,” Gonzalez said.

Judges and commissioners have the power to set aside decisions when evidence of fraud arises, and Gonzalez plans to prove that he was denied due process.

“Every time I think about it'” Gonzalez said, “I feel like I got robbed.”