More than 500 county residents have been kicked out of a tax

relief program aimed at preserving farmland, while state

legislators have ensured that another 2,000 property owners will

continue enjoying the program’s benefits.

Gilroy – More than 500 county residents have been kicked out of a tax relief program aimed at preserving farmland, while state legislators have ensured that another 2,000 property owners will continue enjoying the program’s benefits.

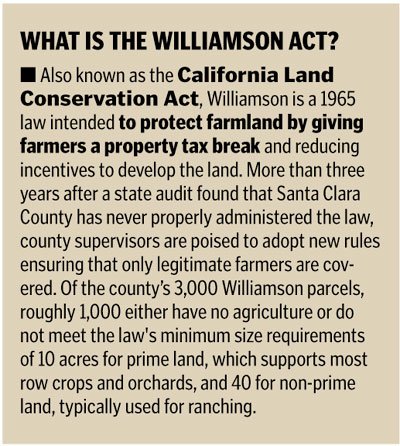

State legislators in Sacramento have rejected Gov. Arnold Schwarzenegger’s proposal to trim $39 million from the state budget by shutting down funding for the Williamson Act, a 40-year-old law that provides tax breaks for farmers and ranchers.

A loss of the $360,000 subsidy Santa Clara County receives annually could have spelled the end of the program, given the county’s $227 million budget deficit.

“Without the Williamson Act, the assessor would be required to value the property at its highest and best use, and in most cases, for urban counties such as Santa Clara, it would drive agricultural uses out of existence,” said Santa Clara County Tax Assessor Larry Stone. “The income from agricultural production simply wouldn’t justify the higher assessments and property taxes.”

The end of the program would also mean years of wasted effort reforming the county’s management of the Williamson Act. A 2002 audit by the California Department of Conservation found that roughly 1,000 of the county’s 3,000 Williamson Act properties failed to meet the law’s requirements: Either they had no agriculture or they fell short of the minimum lot sizes of 10 acres for prime land, which supports most row crops and orchards, and 40 acres for nonprime land, typically used for ranching.

“It took a solid three years to come up with new guidelines” for local enforcement, said Jenny Derry, executive director of the Santa Clara County Farm Bureau. “(For instance), the guidelines were changed so that you have to prove agricultural viability of a property by showing income from the operation and proof that it’s commercially viable. You can’t just have hobby agriculture, like owning a couple of horses, and expect to get the tax breaks.”

Property owners who failed to qualify under the new guidelines began receiving notices of “nonrenewal” last year from the county planning department, which administers the individual Williamson Act contracts for each property owner. The 515 property owners who did not have their contracts renewed were mainly those with parcels less than five acres in size, and those living in residential subdivisions, according to Michael Lopez, the county’s planning manager.

Of those, just four owners have appealed eviction from the program on grounds that they have a qualifying farm operation, Lopez said. One of them has since withdrawn the appeal.

Another 115 people appealed the “nonrenewal” as a way to postpone increases in their tax bills. As part of the program, the county agreed to not raise taxes for three years on properties kicked out of the program, as long as the owner files an appeal. The low number of people protesting removal from the program – as opposed to those delaying it – speaks to the thoroughness of reforms, Lopez said.

“There were inspections done before we sent out those letters,” he said. “We had people go out and look at the property, check out the pesticide reports. We tried to be pretty conscientious about it.”

The county plans to send more than 390 “nonrenewal” notices out in August, this time to property owners who fall short of the 40-acre requirement for ranchland.

The county has no formal monitoring plan to keep the Williamson Act free of abuses in the future, though Lopez said officials will rely on annual questionnaires mailed out by the assessor’s office. The inspection and permitting process will also weed out properties that no longer have active farming or ranching operations, Lopez said.

In the past, the Williamson Act fell into disarray because the county simply did not keep tabs on properties during the routine course of business.

“We were involved in so many other things as county government, it kind of fell by the wayside,” Lopez said. “We weren’t looking closely enough.”