GILROY

– Two days after City Council allowed Bonfante Gardens to

default on $28 million of municipal bond loans, one of the park’s

creditors is calling foul.

GILROY – Two days after City Council allowed Bonfante Gardens to default on $28 million of municipal bond loans, one of the park’s creditors is calling foul.

A.L. “Bud” Byrnes, a Southern California-based investor who represents parties controlling $2 million of Bonfante Gardens’ debt, says the Hecker Pass park should be closed today. Not just dark for the off-season, but shut down for good.

Byrnes, who is a former state-level technical adviser on municipal finance, says bondholders should foreclose on the $116 million park and get the money they are owed.

Byrnes is angry that the city changed the park’s bond agreement, which had said the trustee of the bonds – Bank of New York Western Trust Company – must seize cash and assets within five business days after a default notice is received. Now, the agreement says the trustee can seize cash and assets only if a majority of bondholders requests it. And the majority, Putnam Securities, has no immediate plans to do so.

“They’re trying to do a cram-down deal when they should be foreclosing on the park,” Byrnes said. “The value of the land in the park is worth more than the $28 million senior bondholders are owed.”

Byrnes says the park’s bonds have been devalued enough and it’s time creditors with liens on Bonfante Garden’s get their money back. Under a foreclosure, creditors would get the park’s cash and assets, starting with the bondholders who have liens on the property.

Byrnes says this may not happen because he worries the park’s board of directors and the City Council may be personally and politically beholden to Michael Bonfante, who has $7.5 million in bonds without liens.

“I’m afraid small town politics may have worked to the detriment of the bondholder,” Byrnes said. “The small investor is not being well served.”

City Council approved the amendment Tuesday at the sole request of Putnam Securities. Putnam Securities has this level of power because the creditor owns more than half of the $28 million worth of senior bonds – bonds with liens.

“There’s a second half to the expression ‘majority rule,’ it’s called ‘minority rights,’ ” Byrnes said.

Byrnes said the city, the park and the trustee of the bonds should have been conferring with minority senior bondholders which may number around 300.

“They’re not working in the best interest of all the senior bondholders,” Byrnes said. “The only reason I knew about (the amendment to the bond agreement) is by accident.”

Byrnes said he had to call the trustee on his own and he did not receive default notices, an apparent violation of the bond agreement, he said.

Bonfante Gardens board president Bob Kraemer held steadfastly Thursday to claims that a solvent park is what’s best for all creditors.

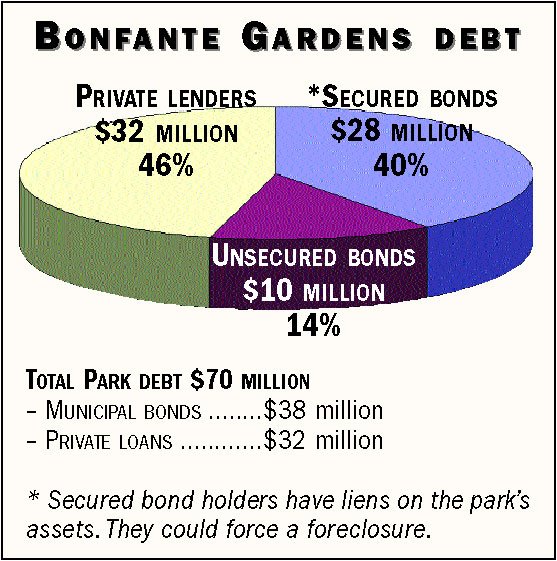

The park, the city and Putnam Securities say a foreclosure on Bonfante Gardens now would make it impossible to operate the park next season. Since the horticultural amusement park finally turned a profit last season, Putnam Securities figures its best chance of making its money back is to let the park continue to operate, giving them time to work out a pennies-on-the-dollar buyout of so-called junior bondholders who own $10 million in bonds without liens.

“That’s such an incredible signal that people believe in the process,” Kraemer said.

Kraemer said Putnam and the junior bondholders are “very close” to inking a buyout deal. According to Byrnes, $18 million of the senior bonds were sold at 90 cents on the dollar before the park opened, giving senior bondholders wiggle room worth 10 percent.

Byrnes remains unswayed.

“If they are making a profit then why are they in default?” Byrnes said.

Bonfante Gardens missed a $200,000 December payment on the $28 million of senior bond debt. The park already has missed several payments on the $10 million of junior bond debt.

Bonfante Gardens has another $32 million of debt in private loans, totaling $70 million debt overall. Raley’s markets loaned Bonfante Gardens $10 million and has a lien on the property, City Treasurer Mike Dorn said. Other high-profile lenders are John Fry of Fry’s Electronics, South Valley Bank and General Electric.

Money from “rainy day” funds, automatically set up during the bonding process, is paying the senior bond holders for now. But that account is expected to dry up in one year.

Byrnes says he would wait out the year before contacting the trustee to inquire about foreclosure.

Ironically, waiting one year is what Byrnes thinks Putnam Securities may be doing, too.

“It’s purely speculative, but this kind of litigation is expensive. It may be more prudent to receive payments for another year, and if things don’t turn around, then foreclose on them,” Byrnes said.

Officials with Putnam Securities could not be reached before deadline. Kraemer Thursday rejected Byrnes’ claim.

“The big guys don’t mess around with things like this,” Kraemer said. “All parties have been intensely working on a solution and when that agreement is reached the components will become public.”