Residents chattering away on mobile phones, watching television

beamed down by satellite, and typing text messages to friends are

simply killing the city budget, according to officials hoping to

slap new taxes on high-tech communications.

Gilroy – Residents chattering away on mobile phones, watching television beamed down by satellite, and typing text messages to friends are simply killing the city budget, according to officials hoping to slap new taxes on high-tech communications.

Gilroy and other local governments across America face a common plight: A once steady stream of phone taxes is vanishing as people scale back their use of traditional land-line phones, or switch entirely to wireless phone providers and other communication technologies.

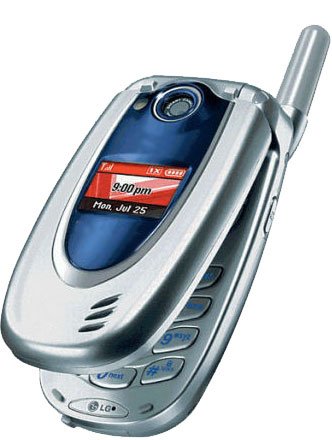

Now, as the dwindling tax source comes under assault in courtrooms and Congress, Gilroy officials hope voters will shore up the city budget by agreeing to a 4.5 percent tax on bills for cell phone use, satellite television, and pretty much anything else that comes down the technology pipeline.

“Back a long time ago, they used to tax your horses,” City Councilman Craig Gartman said. “When that technology changed to cars, then they had to change along with it. This is very similar. The revenue streams have to change with the times.”

Still, the councilman hasn’t decided if he’ll vote Monday to place the Communications Users’ Tax on the November ballot. City staff members argue that the tax is necessary to head off a loss of $1.5 million in tax revenues from the Utility User’s Tax, a 1971 law that levies a 5 percent tax on cable television and phone bills.

A number of lawsuits are now challenging the legal foundation of the Federal Excise Tax, the model for Gilroy’s current UUT, and in 2006, the IRS decided to stop collecting the tax on all long-distance communications. Congress is now considering two bills to repeal the excise tax, further eroding the legal foundation for Gilroy’s UUT.

For a city outspending its revenues by several million dollars annually, the loss of the UUT “could have a devastating impact” on the city’s $42 million budget, according to an analysis by the Gilroy Finance Department.

“We want to make sure that we’re not in a position where things are outlawed and we lose the ability to collect these taxes, which are so important to our city,” said Mayor Al Pinheiro.

Under the city’s proposed plan, officials would lower the overall communications tax from 5 percent to 4.5 percent, and extend it to any form of wireless or Internet-based communication. That includes Internet-based phone service across high-speed cable connections and pre-paid cell phones. Telecommunications companies like AT&T or Cingular would be charged with levying the tax if the primary place of service is in Gilroy, whether for business or personal use.

Jonathan Ford, a Gilroy resident who works in San Jose for Fairchild Semiconductor, didn’t like the idea of paying taxes on a land-line phone and cellular phone – though the latter bill is paid by his company.

“Why should the city get any part of that?” he said Friday outside of Starbucks on First Street. “They’re not putting up the cell towers. Now, if they were going to turn the city wireless, I would understand paying for it. But to tax something because they’re losing money is crazy.”

David Camacho, owner of a local gym, said he pays about $80 a month for his cell phone but doesn’t have much use for the fancy extras like text messaging.

Though sympathetic to the city’s plight, Camacho said he likely will not support the tax if it appears on the November ballot. His final criteria for judgment?

“Once the smoke clears,” he said, “if the consumer’s going to benefit, I’m all for it.”

Officials will debate Monday whether to place the Communications Tax on the November ballot. The meeting takes place at 5pm at City Hall, 7351 Rosanna St.