A U.S. District court judge last week denied a request by a San

Francisco real estate developer to withdraw his guilty plea after

he had admitted to tax fraud and

”

taking

”

threatened salmon from Little Arthur Creek near Gilroy.

A U.S. District court judge last week denied a request by a San Francisco real estate developer to withdraw his guilty plea after he had admitted to tax fraud and “taking” threatened salmon from Little Arthur Creek near Gilroy.

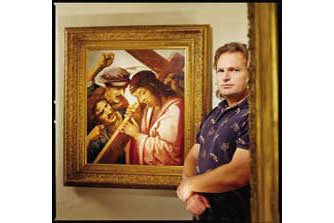

Judge William Alsup decided May 3 to deny Luke Brugnara’s April 14 plea withdrawal request. The developer originally pled guilty Jan. 26 to multiple poaching, obstruction and tax evasion charges.

“The record clearly shows that defendant has repeatedly attempted to game the system in this action for purposes of delay by changing attorneys and changing his plea multiple times,” Judge William Alsup stated in a court order. “He will not be permitted to do so any longer.”

Alsup noted in the order that Brugnara already had pled guilty twice. The court let him withdraw his plea once, and then he pled guilty again on the eve of his trial in January, Alsup said.

He also noted that Brugnara was arrested on a complaint for threatening to kill witnesses on Jan. 22, just a few days before his trial was set to begin. He pled guilty to all charges in that matter on Jan. 26 shortly before jury selection, Alsup said.

In addition, federal agents photographed Brugnara with his mother on Feb. 8 at a residence he owned in San Francisco after he had been ordered to stay at his mother’s home with electronic monitoring, Alsup wrote.

The judge also took issue with Brugnara’s arguments regarding why he should be able to revoke his guilty plea. Brugnara’s attorneys had cited a conflict with his former attorney, Harris Taback, as well as a “manic episode” among some legal technicalities as reasons to withdraw those pleas. However, Alsup stated in his order that Brugnara had said in November that he was pleased with Taback’s representation. In addition, Alsup said a psychiatrist had concluded on Jan. 26 that Brugnara “was not impaired by any mental disorder from being able to understand the nature and consequences of his decision or to cooperate rationally and meaningfully with counsel in preparing a defense.”

Brugnara, who used his company, Brugnara Corporation, to purchase 112 acres, a cabin, four other structures and a dam in west Gilroy at 4850 Redwood Retreat Road, blocked the flow of Little Arthur Creek between January and April 2007 or longer, according to a federal indictment. The creek is an important watershed for steelhead, according to the state Department of Fish and Game and the federal National Marine Fisheries Service. Regulators say that the habitat above the dam is critical to the breeding and survival of the South-Central California Coast steelhead, which are found in Little Arthur Creek and are listed as threatened on the federal Endangered Species list.

State and federal investigators said they found many trapped adult steelhead downstream of the dam that could not migrate upstream to a suitable spawning habitat. A rescue team, consisting of state and federal representatives along with members of the local group Coastal Habitation Education and Environmental Restoration, noticed March 24, 2007, that fish that had been in the pool below the dam were gone.

Brugnara initially denied fishing for steelhead on his property after the rescue team said they found a pair of boots, footprints, a fishing line with hooks attached and two McDonald’s receipts with recent dates. However, he ultimately admitted that he and a friend had been fishing there, although he said they did not catch anything and used a fishing lure that would have prevented them from catching steelhead. The Attorney General’s office said Brugnara lied about his intentions to catch fish and about the type of lure he used.

Brugnara also pled guilty to filing false tax returns in 2000, 2001 and 2002 and to obstructing the Internal Revenue Service. A federal indictment alleged that he had failed to report the sale of four properties in San Francisco and one property in Las Vegas. The indictment also alleged he had failed to report as income some personal expenses that had been paid to his corporation. Court documents also stated that Brugnara had provided a lender with invoices from a non-existent tax service as well as corporate tax returns and a statement that he owned more than $400 million of artwork – both of which had never been filed.

The maximum statutory penalty for each count of filing a false tax return is three years in prison and a fine of $250,000, plus restitution, if applicable.

The maximum penalty for each false statement charge regarding the poaching is five years imprisonment and a $250,000 fine. The maximum penalty for each Endangered Species Act violation includes six months imprisonment and a $25,000 fine.

Brugnara initially was scheduled to be sentenced last week for all of the crimes he admitted to committing, but the court has since postponed his sentencing until May 24 for tax evasion and June 16 for poaching and obstruction.