Despite the fact Gilroy City Council shot down a possible joint city-school sales tax that would help safeguard the Gilroy Unified School District from a possible $8.1 million cut in state funding next year, some school board trustees haven’t dismissed the possibility of pushing for a re-vote on the measure. It could yield up to $11.5 million annually depending on a 0.25, 0.50 or 1 percent local sales tax increase.

When asked if he was still interested in exploring the chances of a re-vote – which would have to occur as soon as possible at either a special meeting or the next July 16 City Council meeting in time for the Aug. 10 deadline to get the measure on the November ballot, GUSD Trustee Jaime Rosso replied, “as far as I’m concerned, we’re not done until we’re done.”

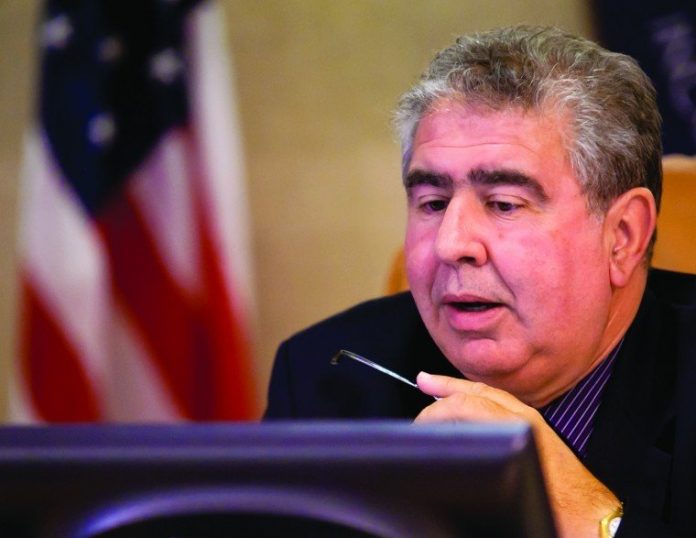

During its June 25 meeting, City Council voted 4-2 to put a halt to the sales tax proposal, with Mayor Al Pinheiro and City Council members Bob Dillon, Dion Bracco and Cat Tucker casting “yes” votes against placing it on the ballot. Councilman Peter Arellano and Peter Leroe-Munoz opposed the motion. Councilman Perry Woodward was absent.

“That meeting was not meant to be the final discussion of this matter,” said GUSD President Rhoda Bress, referring to the fact that Board of Education was not anticipating a vote to be taken during the June 25 special meeting at City Hall.

School trustees and City Council members were previously scheduled to discuss the matter in depth during a joint city-school meeting July 17, which City Administrator Tom Haglund canceled as of Tuesday.

“That vote was a premature one,” said Bress. “I would like to have the opportunity to address the concerns and see if we couldn’t come up with a better solution.”

While trustee Mark Good “obviously” hopes that City Council would be willing to revisit the city-school sales tax, he’s skeptical on the chances of a re-vote. The fact Haglund canceled the July 17 meeting “tends to suggest to me that reconsideration is not even on the horizon,” he said.

“As far as I know, we would still like to see it happen,” he added. “But I would like to see other things happen that are beyond my control. The ball is in the city’s court.”

Given that Councilman Perry Woodward told the Dispatch in mid-June he would vote “yes” to put the measure before voters – so long as GUSD covers the expenses of placing the measure on the ballot and the ongoing costs of administering the tax – Perry is one of “two key people” whose vote would play a roll in reversing the decision, should City Council re-visit the measure, Rosso said. The tax measure needs four votes by Council to get on the November ballot.

Perry’s vote is “key,” as it would constitute one of four necessary votes to get the measure on the ballot. He probably won’t push for a re-vote, however. There’s no point, unless one of the council members who previously voted “no” – and wanted to call for a re-vote – would be the linchpin.

In order to reconsider an item that was voted upon, City Clerk Shawna Freels explained that if one of the majority voters wanted to re-visit the issue, this could take place at a subsequent meeting. Doing so requires consensus from a majority of City Council members, however.

“That’s how our council typically handles it,” Freels explained. “We would have to have the majority agree with them to bring the item back at a subsequent meeting.”

Perry, who was traveling out of the country when the vote was taken, said he was “surprised” at the opposing stances taken by Pinheiro and Tucker, given the “obvious and dire circumstances that our school district is facing.”

“The community has shown itself as willing to step up, and to not even give the community a chance surprised me, frankly,” he said. “If you had asked me two months ago how I thought the council would vote, I would have said 5-2, with Bracco and Dillon voting ‘no.’”

As of Wednesday, Pinheiro and Tucker say a re-vote isn’t in the cards.

“I don’t see me changing my vote,” said Tucker.

Both expressed discomfort over categorizing the measure as a “general” sales tax – which only requires a 50 percent plus one majority vote – as opposed to a “specific” sales tax, which requires a two-thirds vote.

As the ballot language would explain to voters that the tax money would go toward schools, helping stave off more furlough days, class size increases, cuts to the school year, etc., Pinheiro views this as a “sneaky” general tax under the guise of a specific tax.

“It’s just way to circumvent the two-thirds tax without having to get the two-thirds vote,” he said.

Even if the city were to specify on the ballot that the money would go to GUSD, “the fact still remains that if we were to collect his money, it goes to our general fund,” said Tucker. “We have a healthy reserve in our general fund, so legally there’s no reason for us to say ‘we as a city need this money.’”

She’s also wary of potential lawsuits; an issue that was brought to City Council’s attention during the June 25 special meeting. Council was made aware of several “legal issues” and “potential consequences” of allowing the sales tax on the ballot, such as how the sales tax could be consider a “gift of public funds,” which is illegal in the state, and the fact that school districts are not independent agencies, but agencies of the state, which has the authority to take money from one school district and transfer it to another.

While Tucker agrees the school budget is a “huge problem,” she says local governments do not have the capacity to solve the crisis on their own.

“The state is accountable to pay for education…let them come up with the solution,” she said. “There are bound to be other solutions that we could benchmark. I want to wait an see what the best possible answer is for us…you can argue all you want about how our schools are in trouble – and I agree with that – but it’s not the City of Gilroy’s responsibility to bail them out.”

Since casting their ‘no’ votes,’ Pinheiro and Tucker said they haven’t received any disapproving feedback or phone calls from community members.

Rattling off other locally proposed tax initiatives from Saint Louise Regional Hospital, the Santa Clara Valley Water District and the Santa Clara County, Pinheiro said the bottom line is that “people are tired of all these taxes.”

“It’s tough right now for everyone,” he said. “I’m very sorry that we can’t find a way to get the school district money, but we as a City Council must take care of the City of Gilroy…I understand GUSD has to have ways to try and take care of their business. I just don’t agree that this is a way that I want to participate in.”

Bress anticipates the budget crisis will be a major agenda item on the next regular school board meeting 7 p.m. July 19 at district offices, located at 7810 Arroyo Circle in Gilroy.

One other revenue-generating measure the district had previously considered was a flate rate or variable rate parcel tax, which require a two-thirds vote and will yield an annual $1 million or $2 million respectively. Rosso said the school board could revisit this action, although Bress and Good are doubtful it’s worth the effort since it wouldn’t raise anywhere near the $8.1 million in state cuts that GUSD is currently facing.

“I don’t think the property tax is a viable option,” said Bress. “Even if it passes, we won’t be able to raises the funds we need in order to save our instructional days.”