Residents tonight have their first chance to weigh in on a

proposed city purchase of Gilroy Gardens Family Theme Park, a

controversial deal with a price tag between $13.75 million and

$25.4 million.

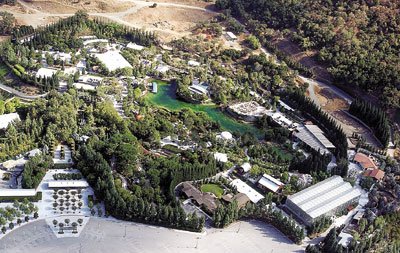

Gilroy – Residents tonight have their first chance to weigh in on a proposed city purchase of Gilroy Gardens Family Theme Park, a controversial deal with a price tag between $13.75 million and $25.4 million.

The potential costs are based on three financing plans that will be unveiled at a 6pm meeting tonight in City Hall. Council members discussed the options in closed session Monday night and released the figures to the public Tuesday. Tonight, they plan to hash out the merits of the plans and let residents voice opinions on a deal that has inspired strong reactions since March, when the financially troubled west Gilroy park offered to sell its 536 acres along Hecker Pass Highway.

“Obviously, the least cost to the city is the most appealing option,” Mayor Al Pinheiro said Tuesday. “That might be the one that looks most favorable, but we’ll hear what the people have to say.”

Financing the Purchase

Financing options devised in the last two months by city staff and bond experts could involve any one or a combination of three approaches, explained Pinheiro, City Administrator Jay Baksa and Assistant City Administrator Anna Jatczak.

The most expensive option would involve issuing 20- or 30-year bonds repaid by pools of money in the city’s Capital Improvement Budget, typically earmarked for new buildings and other public projects. The city has leveraged tens of millions of dollars in such funds in recent years to build a new corporation yard, police headquarters, and a host of other facilities. The ultimate cost under such a plan hinges on the length of repayment. A 30-year bond is expected to cost as much as $25.4 million, according to Jatczak, who headed the group of staff charged with devising financing options.

“We would plan to aggressively pay that down if we go with debt financing,” Jatczak said. “We would not keep that outstanding for 30 years.”

The remaining two options involve “borrowing from ourselves,” Jatczak said. Rather than gradually repaying bonds with unused money in the sewer fund, for instance, the city could take the money as an “interfund loan” and repay it at prevailing interest rates. The city has enough “uncommitted funds” in its equipment, fleet, storm drain, and information technology budgets to finance the $13.75 million purchase of the park, but such a deal would “max out” officials’ capacity to leverage additional money in a similar fashion, Jatczak said.

The third option involves a “bridge loan,” using funds earmarked for the city’s future arts center. Construction of the facility has been delayed as the city updates a business plan and construction estimates for the center, which officials had earmarked nearly $9 million for during the next three years.

Officials stressed the city is not trading the arts center for Gilroy Gardens, and that any funds borrowed from the center’s budget must be repaid.

Such funding would also have to be pooled with bonds or money from the city’s general fund to come up with $13.75 million. In addition to the costs of debt financing, the price tag includes $12.4 million needed to pay off Gilroy Garden’s creditors. Park creditors are not required to sell their bonds until 2010, and officials predict that most will hold on to their tax-free, high-interest investments until that year.

In the meantime, officials are touting the park purchase as a windfall for the community. The city, they point out, has the opportunity to pay a fraction of the market price for land valued at roughly $60 million in recent years. Additionally, the purchase would eliminate the need to spend $25.7 million during the next 20 years on a regional park and public works facility for Gilroy’s west side.

“If we do this, it comes right of out of the (long-term) capital improvement budget,” City Administrator Jay Baksa said. “There is a true cost avoidance here.”

The financing options, which represent a significant step forward in the city’s efforts to purchase the park, come as a group of developers continue pressuring the city and the park’s nonprofit board of directors to sell them the land for use as a water park and resort.

Councilman Craig Gartman has said the city should remain open to such options, while Councilman Dion Bracco and Pinheiro have dismissed large-scale development for the site.

“I look at this as an opportunity to have the jewel of Gilroy kept in a more pristine state,” Pinheiro said.

Any discussion of development options is premature, he said, adding that if the deal goes through, the city plans to assemble a task force to decide the park’s long-term fate.

The park is under the gun to shore up its financial reserves by November 2008 or face foreclosure at the hands of investors. In the meantime, park officials have enough in their reserves to make a November debt payment to investors.