Retail sales dropped again in April after a modest rebound in

March, continuing the larger six-month slow down that has cost

Gilroy more than $550,000.

Retail sales dropped again in April after a modest rebound in March, continuing the larger six-month slow down that has cost Gilroy more than $550,000.

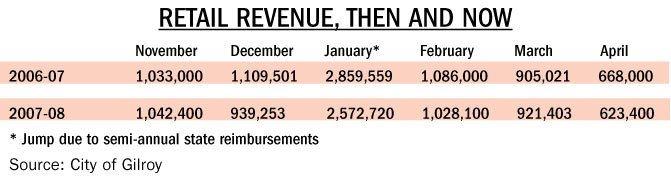

Since November, sales tax revenue has fallen 6.9 percent, or $552,605, compared to the same six-month period between 2006 and 2007. Sales tax accounts for about 35 percent of the city’s general fund revenue, which is the source of the city’s discretionary money, including salaries. The revenue decline since November represents slightly more than a 1-percent hit to the general fund, which is already running a $4.8 million deficit.

Comparing the same time frames, the city of Morgan Hill actually saw sales tax revenue increase 1.6 percent, or nearly $40,000, according to city figures. A new, larger Target recently opened in the new shopping center off Cochrane Road east of U.S. 101, but a Morgan Hill financial employee said she could not comment as to why the increase occurred.

March sales tax revenue in Gilroy grew 1.8 percent compared to the previous year, but this brief relief turned south again last month as shoppers around the country coped with higher gasoline and food prices and tighter credit in general. Local spenders cited these factors but generally said they were curbing spending only slightly.

Last week national retailers reported decent activity in the grocery, health and wellness and entertainment sections, according to financial reports. Flat-panel TVs, video games and gaming systems remained popular items; allergy season fueled drug sales; and cost-conscious shoppers also bought more food and fuel from larger retail chains such as Costco last month. Wal-Mart surprised investors last week when it reported a 3.2 percent rise in April sales at U.S. stores open at least a year; Costco reported an 8-percent gain.

Despite slower overall retail sales, though, the city’s hotel tax revenue managed to rise 2.6 percent during the first quarter of this year, or $172,091, compared to the same three-month period last year, according to city figures.

Larry Cope, president of Gilroy’s Economic Development Corporation, has credited the city’s “cost-conscious” retailers on the east side – such as Costco, Target, Wal-Mart and Kohl’s – as buoys for the local economy, especially during harder times. Cope could not be reached for comment Monday, but next week he will visit Las Vegas, Nev., to rub elbows with 50,000 people representing retailers, restaurants, economic development corporations and cities.

One topic of conversation will surely be the effect of the housing market on local economies.

Developers fund new infrastructure in Gilroy, but with less development, there is less money. City officials expect the city coffers dedicated to building new roads, sewer lines, water pipes and public buildings to earn only $4.4 million this fiscal year, down from the $18.2 million they projected last year. This year’s 75 percent shortfall will equal 50 percent next fiscal year and 25 percent the year after, officials have said. City Administrator Tom Haglund could not be reached for comment, but city staff will present their official recalculations to the city council May 19.

The council will consider the city’s entire financial health next month when it votes on the upcoming fiscal year’s budget. Councilmembers have said they will discuss growing salary and benefits costs, long-term capital projects like the arts center and slowing retail and housing markets. City financial staff have already prepared a multi-step plan that could save more than $50 million over the next five years by cutting full-time staff by 21 percent.

The city of Vallejo declared bankruptcy last week due to unmanageable employee compensation, and although Gilroy has more than $25 million in reserves, Vallejo’s situation has served as a warning shot for Mayor Al Pinheiro.

“We can’t think it won’t happen to us,” Pinheiro said. “The revenue numbers we’re getting here are not encouraging, and we’re not seeing anything that will change things over night.”

“We’re going to have a conversation about a deficit that is greater than we anticipated, but also one concerning the future,” Pinheiro continued. “What is it that this city is ready to do to make some drastic changes?”

In reaction to the city’s managers’ union assembling formally after more than two decades of remaining dormant, Councilmember Cat Tucker reaffirmed her campaign goal to tighten the city’s fiscal belt.

“I absolutely do not want to end up like Vallejo, and I’m not intimidated by bargaining units,” Tucker said. “We’re heading into a recession, and government employees have to face reality just like private sector employees.”

The reality for Gilroy last year was that it experienced modest economic growth. Sales tax revenue for the 2007 calendar year rose 3.9 percent over 2006, but the city’s sales tax base has risen by almost 89 percent since 1998, with a whopping 18 percent gain between 2004 and 2005, according to city figures. Sales tax revenue for fiscal year 2006-2007 totaled $14,540,541, just shy of the city’s budgeted prediction: $14,764,188. The city has budgeted $15.2 million for the current fiscal year that expires June 30, but city officials admit this is unlikely given the current downturn.

Moving beyond retail is one of Cope’s goals, and earlier this year he surprised many in Gilroy with his announcement that an East Coast bio-energy company blazing the way forward in aviation technology will come to Gilroy. The Solena Group, based in Washington, D.C., plans to build the world’s first commercial-scale, renewable jet fuel production plant using biomass and trash.

Until then, retail will likely remain Gilroy’s main economic engine.