Should the Gilroy School Board ask county supervisors to mandate

that a corrected property tax bill be sent out to collect the

”

missing

”

$6 million or wait a year and double the tax on the next

bill?

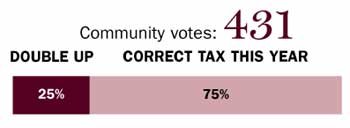

THIS WEEK’S WEB POLL:

Should the Gilroy School Board ask county supervisors to mandate that a corrected property tax bill be sent out to collect the “missing” $6 million or wait a year and double the tax on the next bill?

Correct tax: 5 Double next year: 6

■ They shouldn’t be able to collect it at all. But if these are my choices, double the bill next year.

■ Collect it now – I am sure the district cannot live without it! So unfortunate!

■ Do it now. It will hurt less than doubling it next year.

■ Wait. Undoubtedly the additional cost of a special supplemental property tax bill will be passed onto us taxpayers.

■ I think they should do the cheapest thing. They need to consider the cost of a missed or late payment, the cost of the supplemental billing, the cost of waiting 9 months for the tax payment. I don’t know the answer, but those are the considerations I see. So, take whichever path costs the least, in the long run.

■ Wait a year, so people have a chance to plan for it, also the cost to send an adjusted bill is too high for these economic times.

Vote in