Should banks and lenders be forced to negotiate new loan terms

with homeowners who are upside down in their homes and are facing

foreclosure?

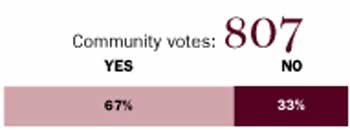

THIS WEEK’S WEB POLL:

Should banks and lenders be forced to negotiate new loan terms with homeowners who are upside down in their homes and are facing foreclosure?

Yes: 6 No: 4

■ No. They should be “incentivized” to do so. That is, if lender receives federal bail-out funds, they must offer to restructure mortgage debt within prescribed limits.

■ No, not as an “across the board rule.”

■ They should not be forced to negotiate new loan terms … but some people deserve a second chance.

■ Yes. The banks do not want the properties. It would benefit the economy if some of the loans are renegotiated instead of going into foreclosure where they sit vacant and lower all of our property values.

■ Yes. But since the banks agreed to lend to these people, perhaps they need an outside party to oversee this process.

Vote in