It’s the most nerve-wracking time of the year (ding dong ding

dong). There are W-2’s for posting, accountants for toasting, and

bank accounts to be drained low. Yes, it’s the most nerve-wracking

time of the year!

It’s the most nerve-wracking time of the year (ding dong ding dong). There are W-2’s for posting, accountants for toasting, and bank accounts to be drained low. Yes, it’s the most nerve-wracking time of the year!

As April 15 closes in, it’s Americans’ favorite time: tax time. After several hours of ritual preparation filled with prayer and cursing, Americans giddily scurry to their local post office on for their 11:59pm service.

There, they make offerings to the deity known as the Internal Revenue Service, whose wrath is said to fall on those who do not complete their ritual in a timely, correct or honest manner, in accordance with the voluminous text known as the “Tax Code.”

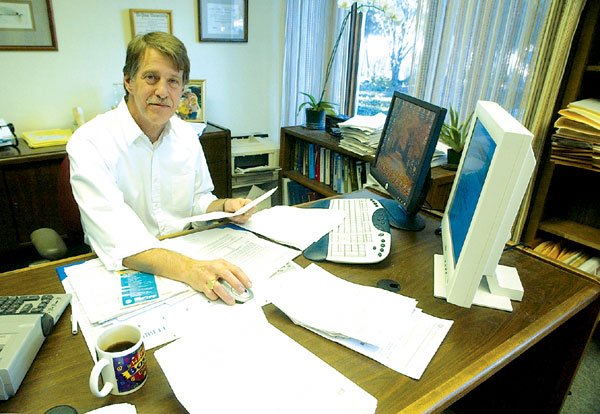

This year, individual filers are likely to run into obstacles at a few key points in their tax preparation, according to Certified Public Accountant Steve Sabath, a partner in Stennes & Sabath, Inc. in Gilroy.

“The government is screwing around with allowing people to deduct the sales tax from their new car purchases,” said Sabath, but some changes slated for 2005’s year-end may actually help taxpayers.

“Next year, they’ve changed the definition of a child. In the code there’s a bunch of different definitions of a child. They’ve had all these definitions floating around for years.

There’s one for a dependent, one for income credit, one where parents are actually listed as the caretakers.

For 2005, they’ve at least come up with just one definition, and they’re trying to standardize that a bit.”

Another potential challenge this year comes from the state, said Bill Brown, an attorney-CPA in Morgan Hill.

“The state of California, as it has several times before, is challenging the head-of-household filers and mailing them asking them to justify their position as head of household,” said Brown. “There are four or five requirements, but generally it has to do with having care of a parent or child and providing more than half their income.”

While many young workers check the head-of-household box in order to reduce the amount removed from their paychecks each month, the section does stipulate that they have at least one dependent.

If they don’t, said Brown, it’s best to contact the IRS and apprise them of the mistake rather than wait for them to catch on.

“If the franchise tax board catches them, there will be penalties,” said Brown, who also noted that he’s seen a dramatic rise in the number of clients being audited. Since 1998, the IRS has not scrutinized a single client of his, but in the last two weeks, he’s received three notices of audit, he said.

Brown’s service rates start at $125 per hour during tax season (half his normal rate), while Sabath charges between $150 and $500 for the completion of all forms, based on the complexity of the filing for an individual client.

“Many times it just takes an hour and a half here in the office for us to get the taxes done, while at home someone’s taking four or five hours just to figure out what they should be doing,” said Sabath. “Some people try to do them on Turbo Tax (a computer program for doing taxes at home) and bring them in to someone for a quick look over, just to end up handing over the whole stack because it1s easier. Some come in, and they think their return is really simple, but they don’t realize they’re missing all kinds of things. I’ve had a couple of guys who think that I’ll explain it, and they’ll go home and get it right. They just end up leaving things here.”

And the most common mistake people make on their taxes?

Simple addition.

“The most significant problem the IRS encounters is erroneous addition and subtraction,” said Brown.

Maybe there should be an addition to the rituals of tax time: check, check and double check.

For more information, like answers to frequently asked questions or instructions on how to use the IRS’s new program called Free File, visit www.irs.gov. To speak with an IRS representative in person, individual filers can call (800) 829-1040, while business questions should be directed to (800) 829-4933.