Gilroy

– California’s share of the $89 billion in tax cuts this year

for the wealthiest 5 percent of the country could have helped

provide health care to 6.6 million children. The $26.3 billion

Californians contributed toward the Iraq war could have paid for

153,464 units of affordable housing. And the

state’s $2.5 billion share of proposed increases in military

spending for 2006 could pay for 36,848 port container

inspectors.

Gilroy – California’s share of the $89 billion in tax cuts this year for the wealthiest 5 percent of the country could have helped provide health care to 6.6 million children. The $26.3 billion Californians contributed toward the Iraq war could have paid for 153,464 units of affordable housing. And the state’s $2.5 billion share of proposed increases in military spending for 2006 could pay for 36,848 port container inspectors.

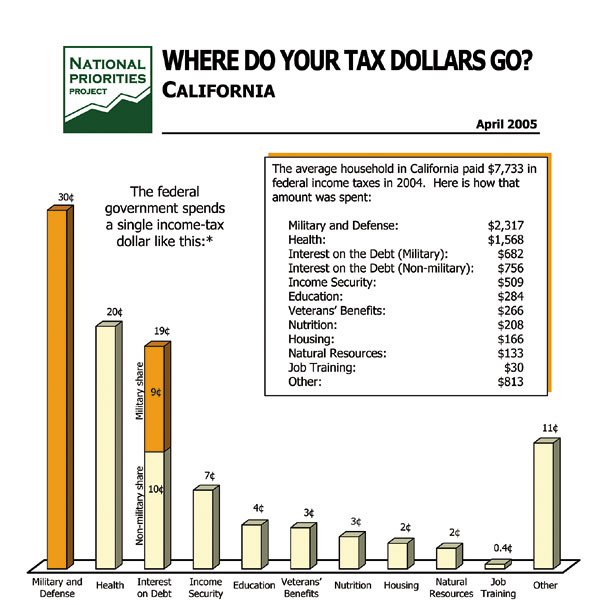

Trade-offs lie at the heart of the country’s democratic politics, and one group in Massachusetts has taken on the mission of putting hard numbers to the give-and-take of government financing. The non-partisan National Priorities Project recently issued its annual breakdown of how the federal government spends Americans’ tax dollars, along with an online database that shows alternative ways the money could have been spent.

The group culls information from the federal budget, in this case for fiscal 2004, and combines it with home prices, health care costs, and other spending priorities based on averages for each state.

NPP’s research director Anita Dancs said the 2004 budget reflects the increasing costs of war and the budget deficit.

“We’re seeing an increase in military spending and a lot of that is because of the Iraq war,” she explained. “We’re also seeing the impact of increasing health care costs. What you’d find if you compared it with previous years was that health was behind interest payments on the debt. Now it’s nudged ahead.”

According to the site, the average California household paid $7,733 in federal income taxes in 2004, with nearly a third of that going toward military and defense spending. Health care costs ate up $1,568 of the household average, while interest payments on the national debt came in a close third.

The government currently has a $589 billion deficit (discounting the Social Security surplus), according to Dancs. To finance that debt, the government used 19 cents of every tax dollar for interest charges in fiscal 2004.

Gilroy resident Ron Wilcher opposed any more tax increases, saying the government needs to cut out some of the fat.

“I think less money ought to be spent elsewhere,” he said. “They just take away too much money from us as it is. They’re spending too much money on Iraq.” We shouldn’t be there in the first place. In Afghanistan, yes, but in Iraq – no. We’re going to be paying for this crazy war for a long time to come.”

The U.S. House of Representatives this week approved a fiscal 2006 defense budget totaling $408 billion, including $45 billion for Iraq and Afghanistan. Those funds are expected to pay for just half a year of operations.

Although strongly against the Bush Administration and critical of the case for war, Gilroy resident Tom Heald felt the country would have to continue operations in Iraq.

“We’ve created a mess that has to be cleaned up,” he said.

Heald added that so far the country has avoided economic troubles because interest rates and inflation have remained low, despite the growing national debt.

Vicente Pilar, who moved to America from Mexico six years ago, acknowledged the need for national security, but questioned the amount of money and attention given to other causes. Currently, 20 cents of every tax dollar supports health programs in America, while only four cents goes toward education.

“We have here in this country a big budget for military and defense,” Pilar said. “In part it’s been necessary because of what’s happened in past years. … I think the government needs to be a little intelligent to find ways (to pay) without affecting the working family.

“The big issues are first health, then education. They are big issues for every country because we have more progress with those. A country reflects who it is by their health and education.”

Dancs admitted that debates on the federal budget and spending priorities rarely penetrate the homes of average Americans, in part due to the complexity of the process. But she believes it is not for a lack of interest.

“I think if the federal budget and if federal policies can be made (understandable) in such a way that it doesn’t require you reading 600 pages or understanding a lot of terminology, if it’s broken down in such a way that your average person … can quickly get the picture, they want to know,” Dancs said. “They care about where their money is going.”

To learn more, visit NPP at www.nationalpriorities.org.