Park requests permits for land off Hecker Pass to keep the

property off auction blocks

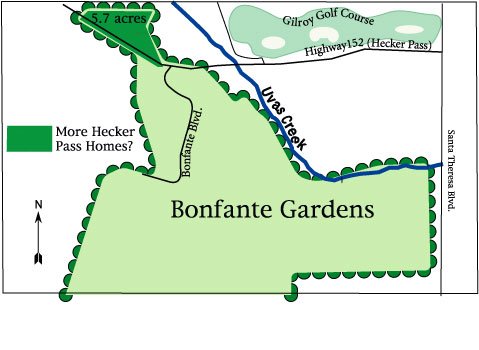

Gilroy – The area’s nonprofit horticultural park, Bonfante Gardens, will again ask city leaders for permission to build homes along Gilroy’s scenic western entrance as a way to keep park lands off the auction block.

The perennially cash-strapped park emerged from its darkest hour last summer when it restructured its debt load from $70 million to $13 million, paying many investors pennies on the dollar.

That deal was made possible by a city council decision in 2004 to sidestep Gilroy’s growth control measure and grant the park 99 building permits, a move that allowed Bonfante Gardens to reap millions from the sale of 33 acres to Shapell Industries. The developer used the land for a northern addition to its gated Eagle Ridge golf and housing community which is currently under construction.

Now Bonfante officials say they need a handful of housing permits for 5.7 acres facing the park’s entrance off Hecker Pass Highway.

“There are two reasons we need to sell more land,” said John Kent, a member of Bonfante’s board of directors and a Morgan Hill developer. “Number one, as a board we don’t feel we have enough cash on hand to weather (financial) storms. … Number two, there is a reserve requirement.”

The park is racing against a June 2008 deadline to bring its reserve fund up to $1.3 million, as promised to creditors during the debt restructuring. Those funds have been drained by interest and principal payments to the remaining bondholders, according to Kent, who believes that three or four homes could generate up to $2 million.

The announcement is an about-face from the park’s six-month effort to market the land for commercial use, though Kent said the failure to fetch a buyer at $25 per square foot “didn’t come as any surprise.” He predicted a residential use would bring in $7 per square foot.

Before Bonfante can obtain any housing permits, the park must get council permission to change the land’s zoning from commercial to residential.

“I’d much rather see some residential units go out there,” Councilman Craig Gartman said. “We did talk about keeping (the area) mainly agricultural and some residential, but we didn’t want to have too much commercial.”

Mayor Al Pinheiro, who is on vacation and could not be reached, has said he would give a new Bonfante proposal the same consideration as any other project. Pinheiro is a city-appointed member on the park’s board of directors. His dual roles have drawn the ire of some members of the community and the Dispatch editorial board, but city attorneys and the state’s Fair Political Practices Commission have cleared the mayor of claims of a conflict of interest. In January, council members re-affirmed Pinheiro’s participation on the board. The mayor remains free to vote on the Bonfante proposal while Councilman Russ Valiquette, an employee of Bonfante Gardens, is expected to recuse himself from any decisions affecting the park.

Housing proposals for Hecker Pass have come under increasing criticism lately as major development plans threaten the area’s bucolic setting. Earlier this year, council delayed plans for hundreds of homes after learning that a road-widening required by the development would mean chopping down dozens of historic cedar trees. Meanwhile, as part of a state-mandated relocation of Uvas Creek bridge, council reluctantly settled on one of two plans that would spare the most historic cedars. Both projects lie within a mile of Bonfante Gardens and are under the watchful eye of environmentalists and neighbors.

Even if the latest Bonfante development bid passes regulatory muster and wins council approval, a final hurdle remains. While bondholders would not have a vote on the sale, they collectively could apply pressure on any decision they find undesirable.

“The bondholders are going to sit tight because we’ve got a lot of security,” said Ken Dekker, who owns $400,000 worth of Bonfante’s remaining debt. “We’ve got the park and all this land around it. You start totaling up the value of all these parcels and you have at least $10 million.”

Dekker and other investors who weathered the park’s financial restructuring have seen their bond values rise in recent months.

“I’m not going to let them sell that land if it does not enhance our security,” Dekker said.