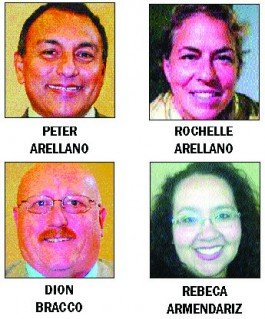

Four candidates on Gilroy’s ballot have filed for bankruptcy in the past, according to federal court documents.

Mayoral candidate Peter Arellano, a doctor at Kaiser Permanente and current councilman filed for a Chapter 7 bankruptcy out of Northern California Bankruptcy Court in November 2004, citing debts to 22 creditors, including Mitsubishi Motors, Princeton University (where his two daughters attended school), Washington Mutual and various credit agencies.

His then-wife, Rochelle Arellano – who is running for a spot on Gavilan College’s board of trustees – is listed as a joint debtor.

A second mayoral candidate, Councilman Dion Bracco, also filed for a Chapter 7 bankruptcy in 1990, listing about $20,000 in debt to credit card companies. Because Bracco’s bankruptcy happened 22 years ago, the records have been purged. Bracco provided the details of his bankruptcy such as how much he owed to his creditors.

City Council candidate Rebeca Armendariz, a union organizer, filed for a Chapter 7 bankruptcy in September 2003, citing debts to eight creditors such as Toyota Motors, Don Roberto Jewelers and various credit and debt recovery corporations.

All of the above candidates were approved for their bankruptcies, which allowed them to walk free from all their listed debts. The only debts that are not discharged in a Chapter 7 bankruptcy are tax debt, student loans, and debts to the court.

The Dispatch asked all City Council and mayoral candidates if they’ve filed for bankruptcy in addition to searching court records for all of them.

A Chapter 7 bankruptcy lingers on the filer’s credit report for 10 years, so Armendariz and Peter and Rochelle Arellano are nearing the end of their term, while Bracco has been cleared for 12 years.

The Dispatch requested the complete list of debt amounts from the federal court cases for Arellano and Armendariz, but the files had not been received before print deadline.

Based on documents the Dispatch has now, the Arellanos bought a new Mitsubishi Diamante on Halloween of 2002 with a price tag of $34,555 plus interest, and agreed to make monthly payments until January 2009. Peter Arellano was three years into his first term as a Gilroy councilman at the time.

Two years after leaving the lot in San Jose with a sedan that had just 47 miles on the odometer, the Arellanos filed for bankruptcy when they were three months behind on payments in November 2004.

Records indicate that he owed $31,703 on a car that by 2004, was worth less than half that amount.

Citing a “breach of obligation,” Mitsubishi attempted to repossess the car in December 2004, “in accordance with applicable state law.”

The Arellano’s car was repossessed as a part of the bankruptcy, according to Peter Arellano.

At the time he filed for bankruptcy, Peter Arellano was no longer serving on the Council after losing the race in 2003, but was elected to another term in November 2005, where he has sat on the dais since.

Peter Arellano, 62, provided this statement over email:

“In your article I hope you list everyone who has ever held elected office in the City of Gilroy that filed for bankruptcy. This will be the right thing to do. There are many people who are American heroes or respected individuals who filed for bankruptcy in the past, for example: Abraham Lincoln, Henry Ford (Ford Motor Company), John Heinz (Heinz Ketchup), Milton Hershey (Hershey’s Chocolate) Walt Disney (Disney Corporation) Mark Twain, Dorothy Hamill (ice skater), David Crosby (Crosby, Stills, Nash & Young), the California Republican Party and Donald Trump (filed four times). There are many personal reasons which forces one to make a difficult decision. I made my decision with a heavy heart during a lengthy battle with a personal health illness that affected my capacity to work at a time that I was paying for two college tuitions.”

Later, over the phone, Peter Arellano, a doctor at Kaiser Permanente, would not answer questions about how long he was out of work.

“That is not something that anyone needs to know,” he said.

Peter Arellano again likened himself to Abraham Lincoln, Walt Disney, Henry Ford and Donald Trump.

“(Bankruptcy) has nothing to do with not being able to manage finances. Look at all our greats in history that have had bankruptcies. Are you going to tell me they can’t handle their finances?”

Rochelle Arellano did not return phone calls or emails.

Bracco described his bankruptcy as a result of a time he was putting his life back together after his 1990 felony arrest for possession of methamphetamines at the age of 32, which the Dispatch wrote about in February 2012.

With $20,000 in debt to “a couple credit card companies,” Bracco said his lawyer at the time advised him to file for bankruptcy for a fresh financial start.

“I really wish I wouldn’t have filed for bankruptcy,” Bracco said. “It was stupid to file for bankruptcy for just $20,000.”

Bracco said he was making “pretty decent” money at the time working at Marx Chevrolet in Gilroy and driving a tow truck at night. Still, his credit card debt got away from him.

“I had a habit,” he said, referring to his “expensive” meth addiction.

When the Dispatch initially contacted Bracco seven months ago about his felony conviction for methamphetime for sale, he repeatedly declined to talk.

Bracco said he “learned his lesson” about finances through his bankruptcy.

“Today I have an 890 credit rating. I own property and a business. I’ve paid my bills, that’s what it takes,” he said.

Bracco said his past financial troubles has influenced the way he often votes against city expenditures he sees as “wants, not needs.”

“I try to spend the city’s money as if it were my own,” he said.

Rebeca Armendariz said her bankruptcy happened during her mid 20s, from a combination of putting “too much” on credit cards and a few unforeseen circumstances.

In her early 20s, Armendariz had scored her first high-paying job and began buying things like a new Toyota and fancy jewelry.

After the birth of her son, she said she was forced to take a lower paying job closer to home – she was a single mother at the time – and the bills began to pile up.

To push Armendariz over the edge, she was sued by a Gilroy woman after her dog got loose with a pack of other dogs and attacked the woman’s sheep, piglet and baby goat.

Armendariz said she used her bankruptcy as a means to settle on paying the plaintiff. Court records indicate that she agreed to pay the plaintiff $1,000 by December of 2004.

“It’s not anything I’m proud of,” she said.

Armendariz looks forward to next year when her bankruptcy will be wiped off her credit score.

“Then I’ll feel like a real, recovered American,” she said, laughing.

Armendariz said she learned a few lessons through her bankruptcy – from financial classes at her bank, she learned how to balance her personal budget and how to not live outside her means.

“City Council members are human beings and they learn things like everyone else – sometimes we learn the hard way by going through them,” she said.

Paul Kloecker, City Council candidate and former three-term councilman, said factors like how long ago the bankruptcy occurred and what circumstances surrounded it should play into how voters perceive a thorny financial past – which is why he said it’s important for candidates to be transparent about their finances.

“It’s their personal business, but the public needs to be made aware of it so they can make their own judgments,” he said. “I think they probably owe the public an explanation.”

Don Gage, mayoral candidate and former Gilroy mayor, said it’s important for candidates to disclose and be transparent about the “skeletons in their closet” like a former bankruptcy.

“Nobody is perfect, but when you are a politician you are always in the spotlight,” Gage said. “People want to know who is representing them. You have to be prepared to give an explanation to voters – your life is no longer private. It’s public.”