GILROY

– With interest rates at near 40-year lows and inventory high,

conditions remain good for home buyers, according to local industry

observers.

GILROY – With interest rates at near 40-year lows and inventory high, conditions remain good for home buyers, according to local industry observers.

“It’s a buyers market at every level because there’s good inventory and interest rates,” said Aytch Roberts of Realty World South Valley in Morgan Hill, who is president of South County’s Realtors’ Association.

Residential sales under contract in Gilroy were down slightly last month compared to February 2002, while the amount of new listings almost doubled and total inventory also increased.

There were 46 residential sales under contract last month against 95 new listings in the Garlic Capital against a total inventory of 195 properties. In February 2002, there were 51 new listings and 51 sales against inventory of 172 properties.

The story was similar in Morgan Hill. Last month there were 62 sales under contract, 103 new listings against an inventory of 244 properties, compared to 83 sales, 80 new listings and 222 properties.

Countywide, 1,049 single-family homes sold last month compared to 1,149 in February of 2002, and median prices remained fairly constant at roughly $549,000 – only a $5,000 jump. Condominium and townhome sales stood at 414 last month, down from 449 last year at this time and the median price jumped $20,000 to $359,000.

While the low interest rates may be spurring interest from first-time homebuyers and those making the jump from low to mid-range homes, demand for high-end homes caused by the exuberance of the dot-com boom seems to be waning.

“For one, the low end is being pushed up in price. There’s hardly anything on the market under $300,000,” in South County, Roberts said. “It’s disappearing because people are moving those prices up.

“That’s pushing a lot more homes into the $500,000 range, and those are selling because people can get cheap money to buy them.

“The homes above $700,000 aren’t moving as fast because there’s plenty on the market and not a lot of buyers willing to spend $700,000.”

Rental availability is also up, Roberts said.

“A few years ago it was really hard to find anything to rent,” he said. “A lot of those people have either moved out of the area because they lost their jobs, or decided to get into home ownership because (money) prices are way down. People are really enjoying the low interest rates.”

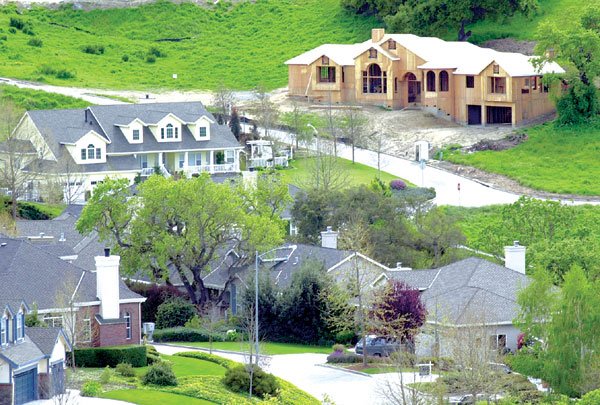

Home starts in South County don’t seem to be fluctuating too wildly because of the way housing is metered by growth ordinances here, said Crisand Giles of the Home Builders Association of Northern California’s San Jose office.

“The way the allotments are done for housing, there’s a long waiting list for the opportunity to build and provide housing in that region, so we haven’t seen it there,” she said.

But in pockets in the Bay Area, depending on the product type the market is in a downturn, Giles said. As with sales, that’s mostly high-end product: anything over $1.5 million per unit in the South Bay as a whole is seeing a downturn, she said.

“We’re not sure at what point in the economy we’ll see that turn back around,” Giles said.