The city inched closer to buying Gilroy Gardens Monday night,

but city council members were split on how much money the city

should make off the park after the purchase and how much control

the council should have over its board of directors.

The city inched closer to buying Gilroy Gardens Monday night, but city council members were split on how much money the city should make off the park after the purchase and how much control the council should have over its board of directors.

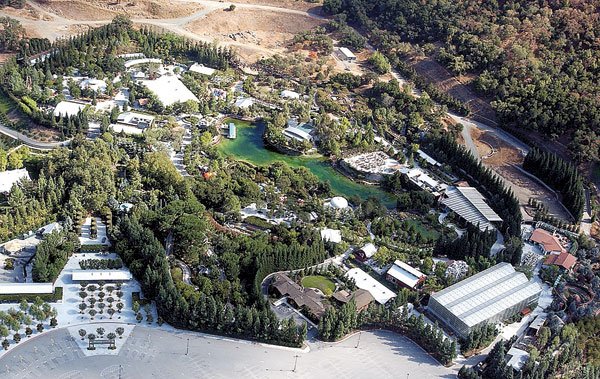

Councilman Perry Woodward said he would vote against the entire $14 million purchase that many see as a real estate steal if the council amended the lease agreement to require a super majority – at least five of the seven council members – for the body to dissolve the park. The city plans to buy the 536-acre park and all of its rides and buildings and then lease the whole package back to Gilroy Gardens’ nonprofit board of directors.

Despite opposition from Woodward, Mayor Al Pinheiro prevailed temporarily Monday night with a non-binding 4-3 vote that directed staff to add the super majority requirement to the lease terms. A binding vote on the park’s lease terms or purchase agreements will take place Jan. 22.

In another non-binding vote, the council voted 4-3 to only charge the park’s nonprofit board of directors $1 per year to lease back the land and rides. Councilmen Craig Gartman, Perry Woodward and Bob Dillon were on the minority of both split votes. Councilwoman Cat Tucker was the swing vote on both.

Under the current lease terms, the council will have the power to dissolve the park’s operations whenever it wants and for whatever reason, but Pinheiro told his colleagues that he wanted a super majority for the council to assume control of the park. If the gardens failed on its own, though, it would naturally dissolve into the city’s hands without a council vote. At that point the council would need to find another park operator or another use for the land, two hypothetical situations that council members agree have hardly been fleshed out.

Pinheiro used to sit on the board as the council representative required by the park’s charter, and Councilman Dion Bracco sits on it now. For this reason, Woodward said the two men would only need to find one more vote on the council to prevent the city from dissolving the historically unprofitable park, which “is fundamentally against the democratic process,” Woodward said.

Monday night was the the first public discussion of the deal since the city and park began hammering out its details. After a Dec. 17 council meeting, compromise became imperative when council members argued about how much the city should charge the park’s nonprofit board of directors to lease back operations of the park. Money was a sticking point again Monday night.

Dillon repeated his objection to the $1 per year deal and instead leaned toward charging 25 percent of whatever dollar amount the park has left after it subtracts operating expenses from its operating revenue and then adds on other revenue such as interest from investments. During the past six years, that number has averaged about $258,000, which would mean an annual lease payment of about $64,500, according to Assistant City Administrator Anna Jatczak.

This is a far cry from the $1.3 million the park pays to bondholders each year. In its six years of operation, the park has only once earned enough to cover its annual debt payments to bondholders: The gardens ended up with nearly $1.9 million in 2005, leaving plenty of funds to cover its $800,000 payment in November and its $500,00 payment in May. The rest of the years the park has had to rely on reserves to cover its annual payments.

Time is running out before the park must make this year’s $500,000 payment in March, and the board must also shore up another $1.3 million in reserves by November to satisfy a 2005 deal with bondholders. Kraemer and fellow board member Joel Goldsmith noted how difficult this would be and warned that bondholders might foreclose on the property and sell it off piece by piece to developers when the board fails to bolster its reserves. Hence the city’s need to act fast, they said.

But Dillon used all these large dollar amounts to stress that he would not budge on the lease payment issue despite pleas from the park’s board members, Councilmen Peter Arellano and Dion Bracco and Mayor Al Pinheiro, all of whom said the city has similarly cheap leases with the library and the Gilroy Visitor’s Bureau.

If the city opts for $1 per year with Gilroy Gardens, though, residents will want to know why the city is foregoing tens of thousands of dollars in potential lease payments while sidewalks remain in disrepair and the fate of the planned arts center remains uncertain, Dillon said.

But the park will be the residents’ park, Goldsmith told the council. Any money the park saves from a cheaper lease – be it hundreds of thousands or a few million dollars – will go right back into the park, Goldsmith and Board President Bob Kraemer repeated Monday night.

“This is money that the nonprofit (board of directors) desperately needs to be successful and to put back into the park. To take money out of the park (via lease payments to the city) so it can be more politically correct in light of the public – that is something I would like to ask you to reconsider,” Goldsmith said. “Let’s be realistic, though, we’re not going to back out of this deal because of the lease terms … We believe that we’re a part of you, an extension of the city.”

The issue of insurance also came up Monday night, and as an insurance broker, Mayor Al Pinheiro recommended the park continue its $5 million umbrella plan while the city also beefs up its insurance policy with another $40,000 to $48,000 in premiums per year. Gilroy Gardens will assume the city’s extra expenses, according to Jatczak.

Another financial concern was property tax.

Even though the city will own the land if it buys the park (and everything in the park including the rides), the fact that the board has a mostly marketing contract with Cedar Fair means that Larry Stone, the county tax assessor, has no choice but to tax the park. The city and the board may be a nonprofit, but Cedar Fair is not, Stone said.

After the Jan. 22 vote, the city could finance the park purchase by taking out a 20-year loan for about $14 million. The $14 million figure represents how much all of the park’s outstanding bonds will be worth in November 2010, when they are up for sale, plus ongoing consulting and legal fees.

For the next week or so, city staff and contractors will continue conducting environmental reports on the park and surveying its boundaries. So far no red flags have emerged, Jatczak said.