Is $12.4 million for 536 acres, or $23,130 per acre

– including 350 acres of open space – too good a deal to pass

up? And can the city even buy it?

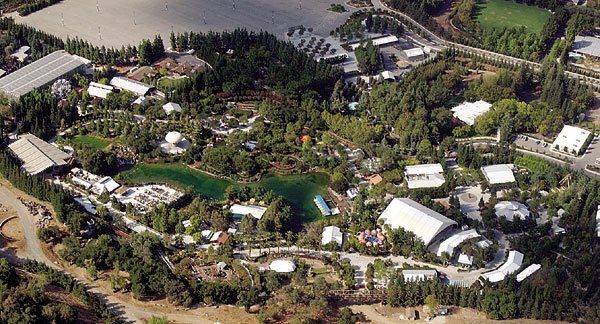

Gilroy – A proposed $12.4 million city purchase of Gilroy Gardens Family Theme Park is not a “bailout” but a potential windfall for the city, according to city and park officials.

At a press conference Thursday morning, representatives from City Hall and the park’s volunteer board of directors presented details about Gilroy Gardens’ financial condition, along with a summary of the risks and rewards posed by city ownership of the park’s 536 acres off Hecker Pass Highway. City council agreed Wednesday night to move forward on a potential acquisition of the site, just two months after park officials approached City Hall with an offer to sell.

“We didn’t come to the city because we’re going to close if they don’t help us out,” said Joel Goldsmith, vice president of the park’s board. “The optimism of the people at the park is the highest it’s ever been.”

The park, which changed its name last month from Bonfante Gardens Family Theme Park, is preparing to open for a seventh season next week and has enough money to pay creditors through most of next year. The biggest looming concern for park officials is a November 2008 deadline to boost reserve funds from $438,000 to $1.3 million. If they fail to meet the mark, they could find themselves at the mercy of creditors.

That leaves a nearly two-year window for City Hall to explore the legal and financial issues surrounding the land sale. Topping the list of concerns is whether Gilroy Gardens, now incorporated as a nonprofit, is even permitted to transfer ownership of the land. The property currently serves as collateral for bondholders, and it remains unclear under what terms the agency could sign over the deeds.

City Administrator Jay Baksa does not believe it will be an issue, but officials are giving city attorneys and bond advisors three months to read the fine print of the park’s bond statements. On a parallel track, City Hall will explore options to finance the purchase of the park.

“If everything works out … the city of Gilroy, for pennies on the dollar, will get an incredible amount of assets,” Baksa said. “From a business standpoint, this is a hell of a deal. Having said that, there are an enormous amount of questions that have to be answered. We have to do our due diligence.”

Risks …

In the meantime, Baksa said officials are trying to answer a simple question: “What’s in it for the city?”

Ownership of Gilroy Gardens carries a number of financial risk for the city, Baksa explained Thursday. Since 2003, for instance, the park’s revenues have covered operating expenses, but only once in that time has the park earned enough to avoid dipping into reserves to make $1.3 million in annual debt payments. If park revenues remain flat or slump, the city could find itself spending hundreds of thousands of dollars annually to support operations and debt payments, Baksa pointed out.

Other risks include:

* park reserves – the city could wind up replenishing the park’s reserve funds in 2008 if they remain below required levels.

* New equipment – the city may have to finance new equipment or facilities, since the park does not tuck money away in “depreciation accounts” to replace aging assets

… And Rewards

While risks hinge to a great extent on the park’s success in a given year, the rewards are easier to quantify.

“When we analyzed this three and a half years ago,” Baksa said, “we were saying a community park would be between 20 and 40 acres and it would cost at least $30 million. Compare that to 536 acres at $12.4 million, ready built. Even if we had to put in $5 to $10 million more over time, you’re getting 20 times the property at almost half price.”

In addition to hundreds of acres of wooded foothills, the purchase would open up an amphitheater, pool and other facilities to the public. It would also complete a nature trail that stretches along Uvas Creek from Hecker Pass to the new sports complex off Luchessa Avenue, in south Gilroy.

The combined sale price for the land and its facilities averages to less than $24,000 per acre. The figure stands in stark contrast to the $469,000 per acre the school district spent for 42.6 acres on Day Road, where it plans to build a high school.

“Personally I see this as an opportunity for investment in the future,” school board trustee Jaime Rosso said at the press conference. “The savings to the public could be substantial. I would find it incredible if we passed up such an opportunity.”

Priorities, Payment Options

Seizing one opportunity, however, could mean passing up others. The purchase will require some creative financing by the city, and any budgetary solution could involve delaying construction of the city’s arts center or library, dipping into city reserve funds, borrowing against monies generated by new housing projects, or some combination of those options.

The final plan will hinge on factors outside the city or park’s control, such as how many of the park’s creditors choose to sell their bonds before 2010. On that date, Gilroy Gardens has a contractual right to buy all of their bonds back at face value. City officials plan to negotiate the price and terms of a potential early buyback, which in turn will determine how much cash the city needs up front and how much it will need long term. Nothing bars Gilroy Gardens – or the city if it acquires the park – from leaving bonds in the hands of investors until their maturity date in 2025.

Mayor Al Pinheiro stressed Thursday that it is “too premature” to detail how the city would use the park, or whether it would continue to operate the rides and attractions located on 160 acres of the land. The public will have a chance to weigh in on the park’s fate in coming months, he said, after officials have finished exploring the financial and legal issues surrounding the deal.

But Pinheiro was able to state one thing with certainty: “I’m not looking to put any housing units out there.”

Since the park’s financial troubles arose five years ago, fear has abounded that it would get carved up for development by creditors. That possibility would vanish with city control of the land, Councilman Dion Bracco said.

“The potential I see in that park doesn’t include selling any property,” he said after the press conference. “It’s to preserve that park for the citizens of Gilroy … I don’t believe any of the council wants to sell it.”