GILROY

– Slow and steady.

That’s the appearance of Gilroy’s latest sales tax numbers, a

trend that has city financial officials optimistic following seven

straight previous quarters of revenue decline.

GILROY – Slow and steady.

That’s the appearance of Gilroy’s latest sales tax numbers, a trend that has city financial officials optimistic following seven straight previous quarters of revenue decline.

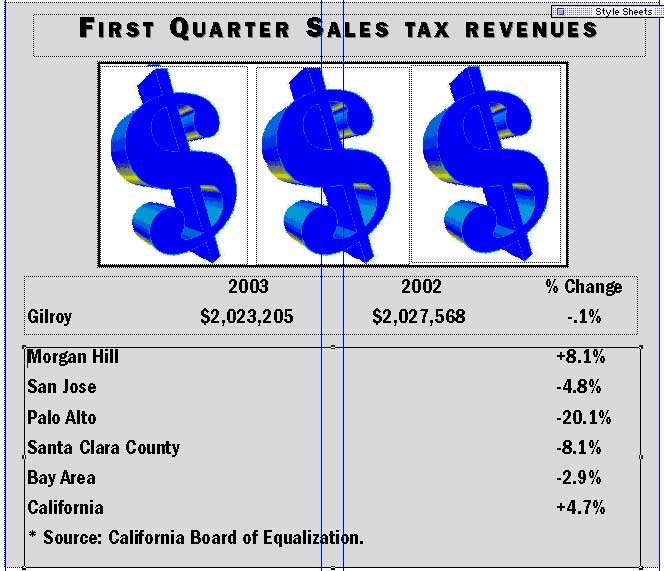

Between Jan. 1 and March 31, the most recent data available, Gilroy put $2,023,205 in sales tax revenues into its general fund – a .1 percent decline from the same time period the previous year.

But the minuscule drop is encouraging news to local businesses and city officials, considering that Gilroy’s sales tax revenue declined 8.5 percent between 2001 to 2002 when comparing the same yearly quarter.

The leveling out of sales tax revenue – the backbone of the city’s general fund, which mostly pays for fire, police and city services – is the most crucial sign that a depressed local economy may be heading out of its economic doldrums, said Irma Navarro, Gilroy’s revenue officer who works with the state Board of Equalization to monitor Gilroy’s quarterly sales numbers.

“It shows that we are climbing out of the slump,” Navarro said. “You look around the area we’re in (Silicon Valley) and you see that we’re fairing pretty well, considering.”

While Gilroy’s sales tax revenue declined only $4,363 – .1 percent – from the first quarter of 2002 to the first quarter of 2003, increases were registered in four of the five major sales categories: retail sales (6.9 percent), food products (.1 percent), construction (1.6 percent) and business-to-business sales (3.4 percent), according to the California Board of Equalization (BOE).

Only Gilroy’s transportation industry, which comprises automobile sales, auto repair and service stations, saw a decline in sales revenue. While transportation’s $682,909 in 2003 first quarter revenue edged out retail’s $653,416 in sales to lead the city, its quarterly revenue declined 7.9 percent from 2002.

“Big purchases like automobiles always take a hit when the economy is bad,” Navarro said. “This year we saw some (of the previous year’s historically low interest rates) for new cars fade, and people couldn’t justify spending that money. At the same time, we’re seeing people begin to buy retail again and spread that to other areas.”

Gilroy businesses such as department stores, liquor stores, office equipment sales, construction material sales and restaurants all recorded revenue increases during the first three months of 2003 when compared with 2002.

“Our clientele has remained steady, but I think overall the restaurant business is doing better than a year ago,” said Don O’Donoghue, owner of O.D.’s Kitchen, 28 Martin St. in downtown Gilroy. “We’re breakfast and lunch, so we’re not as expensive as dinner. I think people are still a little hesitant to spend $30 on a steak dinner, but they feel comfortable they can afford eggs. In that way, we’re lucky to have loyal clientele through the ups and downs.”

While Gilroy seems to be clearing the dust from the Silicon Valley bubble burst, other city’s in the county aren’t so fortunate.

The city’s of Cupertino (-29.1 percent), Los Altos Hills (-21.2 percent), Palo Alto (-20.1 percent) and Santa Clara (-13.4 percent) all recorded double-digit sales tax revenue losses when comparing the first quarter of 2003 with that of 2002, according to the state BOE. San Jose’s revenue decreased 4.8 percent during the same time period.

As a whole the county’s sales tax revenue from January through March 2003 dropped 8.1 percent from the money collected during the same three months of 2002.

The only cities in the county to increase their sales tax from the first quarter 2002 to 2003 were Morgan Hill (8.1 percent) and the tiny upstart community of Monte Sereno (57.2 percent). Morgan Hill’s total taxable sales in 2002 were approximately $4.7 million, compared with Gilroy’s $10.2 million.

California’s total tax revenue increased 4.7 percent when comparing the first quarters of the past two years.

“We live in an area that was the hardest hit in the state by the economic recession, even though as you can see South County has been a little more sheltered from the tech bust,” Navarro said. “You see places around the state like the Central Valley and Southern California already making positive recovery, but up here it is going to take much longer.”

Navarro said the barrage of retail stores planned to open on the east side of Gilroy during the next two years should help speed the recovery process.

With plans for more than 25 chain retailers and restaurants east of U.S. 101 at Highway 152, the new centers are expected to produce $4 million in annual tax revenue to the city.

But because the city shelled out a combined $12.5 million in incentives and development fee waivers to attract the retailers, the general fund will not begin to pocket the new revenue for at least three years.

“The city is really expecting a boost from the new developments,” Navarro said. “Hopefully, by the time we start collecting, the rest of the economy will be recovered.”