Gilroy schools, like many others, are suffering from a lack of

state and local funds because of a $17 billion state budget deficit

and the dismal state of the housing market.

Gilroy schools, like many others, are suffering from a lack of state and local funds because of a $17 billion state budget deficit and the dismal state of the housing market.

The Gilroy Unified School District is being pummeled from all sides with budget cuts, meager developer fee revenues and the inability to sell plots of land in tough economic times.

A recent study of the school district’s facilities revealed that the district will collect an estimated $500,000 in developer fees this year, less than half of what was collected in 2007. The study, conducted by Jim Bush, president of School Site Solutions, showed the district may not even collect that much, based on activity for the first quarter of the year. Only $78,848 in developer fees has been collected between January and March, 18 percent of what was collected during the same time period in 2007.

“If that rate continues, we’re only looking at $200,000 this year, not enough to pay off the COPs,” Bush told the board. COPs refer to certificates of participation, $33 million of which the board approved earlier this year to help fund the construction of Christopher High School.

The COPs are paid off by developer fees. However stunted growth will not provide the funds needed to pay off the COPs in years to come, Bush pointed out. Although the district has enough money in its reserves to pay its COP debt for two years, if the current rate of developer fees is any indication, the third year of repayment could be a tough one, Bush said. The first two years’ payments are about $1.5 million, according the district’s payment schedule. The point of his analysis of the district’s facilities needs was to provide an unbiased view of what the district was in dire need of and what could be delayed.

Bush recommended postponing the construction of a new elementary school. Until the district pumps up its elementary enrollments, it will not be eligible for state funds for a new school. Instead, it may have to come up with creative ways to use its facilities as economically as possible to accommodate students. And until developers start building, GUSD will have to make due with their current elementary facilities. Once new development generates more students, the district might be eligible for more state money. Their predicament is that under the class-size reduction program, GUSD receives state funds for keeping grades K through 3 at a 1:20 teacher to student ratio – “A great program,” Superintendent Deborah Flores said. But the low ratio that qualifies the district for one funding source precludes it from receiving money to mitigate overcrowding.

“The state’s loading formula is not the way most districts load their classrooms,” Flores said. The state loads 25 kids into a classroom before it recognizes schools as over capacity. But the class-size reduction program is an element the district is not willing to give up, Flores said.

“We don’t have developer fees, we don’t have state eligibility,” Flores said. “And we need new facilities.”

As the November election approaches, the idea of going to the polls with a bond or parcel tax is becoming more real, board members acknowledged.

“The district should pursue a GO (general obligation) bond in 2008 to replace the expiring bond and to meet immediate facility needs on existing sites and to address phase two of the Christopher High School project,” according to Bush’s report.

Over the next two weeks, the district will be conducting two phone surveys, one to gauge the voters’ reaction to a bond and another for a parcel tax. The results will be presented at the June 5 board meeting and the board will vote June 19, Flores said. The board hasn’t attached a definite amount to the bond, but Bush verified that the district has about $119 million available in bonding capacity. And Flores said that the district’s need are, in fact, well over $100 million.

“The needs are great but the question is ‘how much will the voters support for a bond?’ ” Flores said.

Trustees and district officials are careful to point out that the approval of a new bond will replace the soon-to-expire Measure J.

“We’re not asking for additional money,” Trustee Francisco Dominguez said. “We’re just asking to continue the old one.”

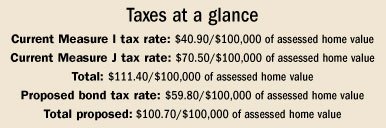

Currently, homeowners pay a combination of $40.90 per $100,000 of assessed home value for Measure I and $70.50 per $100,000 for Measure J. According to the proposal that former Superintendent of Business Services Steve Brinkman put together earlier this year, homeowners will pay $59.80 per $100,000 assessed home value, if they replace Measure J with a new bond when it expires in 2011, for a total of $10.70 per $100,000 less than the current rate.

However, there is no legal option to extend the expiring tax so the district will have to ask voters for their support.

“These are difficult times and the public will have to weigh the value of public schools,” Trustee Jaime Rosso said. “We can’t wait around for Sacramento. This is showing initiative. This is an opportunity for the voters to show how important our schools are. The need is real and it needs to be addressed.”