City Council will discuss Monday whether a measure to increase Gilroy’s sales tax rate from 8.75 to 9.25 percent should be added to the November ballot. If the council adopts the measure—and voters approve it during the election—Gilroy would have the highest sales tax rate of all cities in Santa Clara County.

Originally suggested by Mayor Don Gage last year as a way to specifically fund capital improvement projects like fixing the condemned buildings downtown and repairing streets and sidewalks, the measure would also pay for police and fire services—which already account for approximately 80 percent of the city’s expenditures.

When the concept was being floated, the City had two options: put a sales tax measure on the ballot or a general obligation bond. A sales tax increase only needs 50 percent of the votes cast, plus one vote, to pass. On the other hand, a bond measure needs support from two-thirds of voters in order to pass.

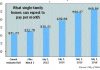

On the purchase of a $35,000 car, for example, the current sales tax in Gilroy would be $3,063. With a half-cent increase, the tax would rise to $3,238.

Between Sept. 30 and Oct. 9, Oakland-based consulting firm FM3 Research gauged whether residents would be receptive to a sales tax or bond measure—and what they’d be willing to pay for. The results, gathered during telephone interviews with 400 Gilroy residents, showed that a majority—79 percent—either “agree” or “strongly agree” the City needs more money to bolster public safety.

The Oakland-based Lew Edwards Group—a consulting firm currently under a $126,500 contract with Gilroy—mailed out questionnaires to garner additional feedback from residents. The firm, in conjunction with the City Attorney’s Office, helped devise the proposed ballot language that says the measure would “improve the quality of life and maintain essential city services.”

In surveys, residents identified priorities for where City funds should go, including expanding gang and crime prevention, maintaining emergency response times, repairing broken sidewalks, improving earthquake safety for downtown buildings, repaving deteriorated streets, modernizing emergency communications, improving police protection and expanding after-school programs for at-risk youth.

But specific projects cannot be guaranteed funding from the measure’s revenue unless more voters approve it. The sales tax measure’s threshold will bump up to two thirds—instead of a simple majority—if it’s written to fund certain items.

Five council members must approve the sales tax measure in order to make the Aug. 8 deadline for ballot items. The meeting will take place at 6 p.m. Monday in council chambers of City Hall, located at 7351 Rosanna Street. The item is scheduled for discussion at approximately 7 p.m.

Read more of the Dispatch’s coverage on the development of the ‘Quality of Life’ measure from the beginning:

http://www.gilroydispatch.com/news/city_local_government/city-bond-measure-floating/article_cf49475e-c3cb-11e2-9beb-0019bb30f31a.html

http://www.gilroydispatch.com/news/city_local_government/polls-positive-for-quality-of-life-tax/article_58c9d630-4255-11e3-8c9c-0019bb30f31a.html

http://www.gilroydispatch.com/news/city_local_government/more-taxes-to-pay-for-police-fire/article_507a4180-94d6-11e3-acca-001a4bcf6878.html