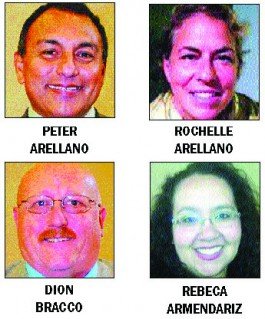

According to court records, mayoral candidate and current Councilman Peter Arellano claimed $670,359 in debts when he filed for Chapter 7 bankruptcy in November 2004.

A year prior, Rebeca Armendariz, union organizer and City Council hopeful claimed $61,000 in debt for her Chapter 7 bankruptcy.

Another mayoral candidate filed for bankruptcy in 1990 – Councilman Dion Bracco – but because his bankruptcy occurred so long ago, the federal record has since been purged.

Bracco attributed his bankruptcy to small debts that eventually added up to $20,000. He filed for bankruptcy during a time he said he was putting his life back together from his use of methamphetamines.

The bulk of Arellano’s debt came from owing $464,342 on his home on Potomac Place, a cul-de-sac near Christmas Hill Park. He reported that the home was worth $475,000 at the time of his filing.

Arellano’s wife at the time, Rochelle Arellano – who is running for a spot on Gavilan College’s board of trustees – is listed on the file as a joint debtor on the file.

Other debts Arellano listed included $44,940 on his vehicle, a Mitsubishi Diamonte LS that he purchased for $34,555 plus interest in 2002, as well as more than $73,000 to five creditors for credit card debt.

He also stated he owed $5,520 to Princeton University, where his two daughters attended college.

At the time of filing for bankruptcy, Arellano was between terms on City Council, after an unsuccessful bid for a second term in 2003. He was later re-elected to Council in November 2005, nine months after his bankruptcy closed in February of that year.

There is no City code that prohibits those with bankruptcies from running for public office.

Arellano, a 62-year-old doctor at Kaiser Permanente, did not respond to phone calls requesting comment about specific debt amounts.

Last week, Arellano told the Dispatch that bankruptcy has “nothing to do” with “not being able to manage money,” using several examples of successful people in history who have filed for bankruptcy, including Walt Disney, Mark Twain and Donald Trump.

Arellano listed about $30,000 in personal property – $2,500 in household goods and furnishings, $2,500 in clothing, his Mitsubishi (listed as having a current market value of just $15,000) and a 1998 Indian motorcycle with a market value of $10,000.

Arellano claimed that he had no cash to his name. He also reported that he had just $31 in checking and savings accounts.

When disclosing all personal property, he also checked boxes stating that he had no jewelry, books, pictures, art, antiques, records, compact discs, collectibles of any kind, firearms or any cameras, sports or hobby equipment, or office equipment.

Kevin Courtney, a tax attorney based in Morgan Hill, represented both Arellano and Armendariz in their bankruptcies. Courtney declined to comment on either case.

Armendariz, 37, filed for bankruptcy in August 2003, with listed debts totaling $61,000 to eight different creditors, including $4,000 to Paula Haeussler, a Gilroy woman who filed a lawsuit against Armendariz after her farm animals were attacked by Armendariz’ dog.

According to court records, Armendariz stated that she also owed $12,000 to Toyota Motor Credit Company for her vehicle (which was repossessed) and $700 to Don Roberto Jewelers for jewelry she returned in the bankruptcy proceedings.

She also listed $1,000 in debt to CBSJ Financial Corporation for outstanding medical bills, $600 to Pacific Credit Service for unpaid dental services, along with $800 to a collecting agency for her Sprint PCS phone bill and another $400 to a creditor for Verizon bills.

Armendariz owned no homes or property at the time, and listed $2,600 in personal property – $500 in family apparel, $400 in household furnishings, and a 1994 Ford Explorer with a market value of $1,700.

Armendariz listed that she had no cash and nothing in her checking or savings account. She also stated that she had no books, pictures, antiques, collections, guns, or equipment for any hobbies.

Arellano, Armendariz and Bracco were all approved for their bankruptcies, which discharged them from the bulk of their listed debts.

The Dispatch asked all other City Council and mayoral candidates if they’ve filed for bankruptcy in addition to searching court records for all of them, and returning no results from mayoral candidate Don Gage or City Council candidates Terri Aulman, Paul Kloecker, Perry Woodward and Cat Tucker.

Armendariz said she has learned a lot since her bankruptcy and has since taken classes through her bank about managing finances. She said that her financial past can actually make her a stronger leader for Gilroy.

“City Council members are human beings and they learn things like everyone else – sometimes we learn the hard way by going through them,” she said.

Council members and the mayor of Gilroy are expected to approve an annual budget and make expenditure decisions for development, recreation, public safety and more.

Bankruptcy law changed in 2005, after the bankruptcies of Bracco, Armendariz and Arellano had been discharged and closed. David Yomtov, a San Jose lawyer, said prior to 2005, it was “much easier” to qualify for debt discharge. “Now it’s harder for your general consumer to qualify for a straight discharge,” Yomtov said. He was referring to the changes to federal law in 2005 to prevent bankruptcy abuse. The new law subjects debtors who make more than the median income in their state (in California, $49,188 for a single earner and $77,167 for a four-person household) to a means test, which determines if the debtor’s income is higher than a significant portion of their debts. If it is, then the debtor cannot qualify for a Chapter 7 bankruptcy, but a Chapter 13 bankruptcy in which the debtor must develop a payment schedule to repay creditors rather than being cleared of all debts.